View / Download Media Release San Jose Mercury News - June 29, 2012

After three years of minimal or negative growth in assessed property values, the Santa Clara County, Assessor’s Office is reporting the first solid increase in assessed values since 2008. “Economists often describe economies in curves, but Silicon Valley’s economy looks more like a check mark. The real question is, will property values continue to grow up and to the right, or will flatten out,” said Assessor Larry Stone.

After three years of minimal or negative growth in assessed property values, the Santa Clara County, Assessor’s Office is reporting the first solid increase in assessed values since 2008. “Economists often describe economies in curves, but Silicon Valley’s economy looks more like a check mark. The real question is, will property values continue to grow up and to the right, or will flatten out,” said Assessor Larry Stone.

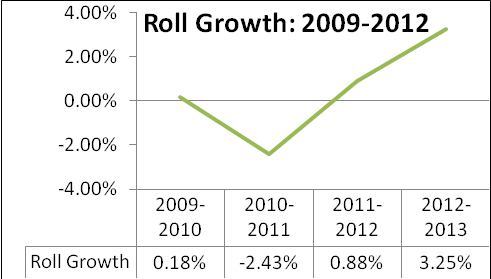

On Friday, the Santa Clara Assessor’s Office will mail 476,000 assessment notices to all property owners in Santa Clara County. The total net assessed value of all real and business personal property grew 3.25 percent to $308.8 billion. Property tax revenue supports public schools and local governments. Assessed values are used to create the annual property tax bills mailed to property owners in September.

Assessment Roll Growth

The annual growth in the assessment roll is a combination of a number of factors including changes in ownership, exemptions, reductions when market values fall below the assessed values (Proposition 8), new construction, and the California Consumer Price Index (CCPI). The assessment roll also contains the value of business personal property, including machinery, equipment, computers and fixtures.

“During the past four years, the annual assessment roll has ranged from $303 billion in 2008, declining to $296 billion in 2010. This year’s assessment roll provides the first concrete evidence that the Silicon Valley economy is finally heading in a positive direction,” said Stone. The assessment roll is a snapshot, as of the valuation/lien date (January 1, 2012) of the assessed values of all real and business personal property in Santa Clara County.

“As a region, the economy has turned the corner. However, it is like a large train with the locomotive up front leading the way, while other parts of the train are still rounding the corner bringing up the rear. “The good news is the trend is in the right direction” said Stone.

The total gross assessed value of all real property (land and buildings) grew 3.13 percent. Particularly surprising was business personal property which grew 6.48 percent to $25.6 billion. That is still $1 billion below the peak during the dot com boom in 2001. The growth of business property is perhaps the best indicator that businesses are once again hiring new employees, leasing office space, and making major purchases of machinery, equipment, computers and fixtures.

The assessment roll growth was driven largely by improvements in the commercial and industrial sector, and a modest increase in residential property values. However, the outcome was uneven geographically across the County. “The front of the train represents the communities primarily in North Santa Clara County with South County trailing,” said Stone. The City of Mountain View and Cupertino grew 6.6% and 6.3% while the City of Gilroy declined -0.4% and Morgan Hill grew 0.01%.

Temporary Reductions in Assessed Values continues to grow

Another interesting anomaly is that despite the overall growth, the number of properties proactively receiving a Proposition 8 reduction in assessed value actually grew by 10 percent to over 136,000 properties reflecting a total reduction in assessed value of $26.9 billion. This is an indication that while the economy has turned the corner, not every area of the county is experiencing the same level of improvement. For example, cities like Campbell, Gilroy, Morgan Hill, and Milpitas recorded an increase in the number of properties in which the assessed values were reduced.

When the market value of a property declines below the previously established assessed value measured as of January 1 each year (lien date), the Assessor proactively reduces the assessed value to reflect the lower market value. However, as the real estate market rebounds, the Assessor is required to “restore” the assessed value for properties previously reduced during the downturn. Proposition 8, passed by California voters in November 1978, provides that property owners are entitled to the “lower” of the fair market value of their property as of January 1, 2012, or the base year value as determined at the time of purchase or construction, and increased by no more than 2 percent annually.

“It is confusing for taxpayers when some properties receive a reduction in assessed value, while others receive a partial or full restoration. The restoration of assessed values is not limited to 2 percent until the market value reaches a property’s purchase price increased annually by a maximum 2 percent. The market solely determines whether the assessed value of a property is reduced or restored,” Stone said.

“It is very dependent upon how long the property was owned, and the geographic area in which it is located. I hate administering this part of the State law. Most people assume that Proposition 13 guarantees them no more than a 2 percent increase in any given year. “However that is not entirely true,” said Stone. If you own a home in which the assessed value was previously reduced, and then the market value increases, the Assessor is required to “restore” the assessed value until the market value is equal to the initial base year value. At that point, annual assessment increases are limited to 2 percent.

Of the 136,559 properties in which the assessed value was reduced, 85,074 (62%) have received either no change or a further reduction. Ninety-seven percent of these properties are single family and condominiums. Ninety-five percent of the properties in which the assessed value was partially restored, are single family and condominiums. Finally, 13,798 properties have been fully restored because the market value is now higher than their Proposition 13 base year value.

“When the value of the principal asset most families own takes a dive, it is extremely stressful. The temporary property tax relief provided, however, is only a fraction of the loss in equity. When market values increase, creating a corresponding increase in property taxes, that’s positive news to property owners as equity previously lost is being restored,” said Stone.

New, First in the State “on-line banking” like tool unveiled

I am especially excited to announce the launch of an entirely new public website (www.sccassessor.org) and a new on-line application, much like on-line banking, that will virtually revolutionize the way taxpayers interact with the Assessor’s Office. Both tools “go live” on Friday, June 29. A screen shot of the site is below.

More than a year in development and timed to coincide with the mailing of the annual assessment notices, this new tool, referred to as “Email Opt-In” offers first in the State interactive services. Modeled after the private sectors on-line banking, the tool enables taxpayers to securely opt-in to receive assessment notices and to interact with the Assessor’s Office electronically, rather than by mail.

This on-line service provides a great savings and improved efficiencies to the Assessor’s Office and property owners. It benefits the environment by reducing the number of trips to the Assessor’s office and a significant reduction in paper documents. It is available 24 hours a day, 365 days a year, and is not limited to Assessor’s Office customer service hours.

Taxpayers who opt-in will be able to download copies of their assessment notices and market comparables if their property is currently receiving a temporary reduction, pursuant to the provisions of Proposition 8. Taxpayers who opt-in will also receive assessment information electronically. In the near future, additional services will be rolled out to taxpayers who opt-in that would otherwise require an ink signature or a visit to the Assessor’s Office. In addition, we anticipate offering property characteristics to property owners electronically.

Only real property and mobile home property owners will be able to use this new feature. Owners of business personal property, who e-file, will continue to have a different login process and PIN.

Assessor’s Website Completely Overhauled

The Assessor has designed and implemented the first, comprehensive, top to bottom overhaul of the Assessor’s website in 10 years. From content to “look and feel”, the entire site has been redesigned to make information easier to find with fewer clicks. In addition, the site has been developed on a platform that will allow continuous improvement and rapid adjustment to changes in technology. High traffic applications such as the property look up tool have also been replaced with a superior, more intuitive and modern interface. Some of the major changes include:

- Customer centric interface designed to bring information with the highest demand to the front of the website. The centerpiece of the new website is an “I’d like to…” feature which will display articles and forms most frequently requested or are likely to be accessed because of a current deadline. Information will be far easier to find and will change according to what is new, recent mailings and future deadlines.

- New calendar feature that will display the most current deadline as well as allow property owners to add an important deadline to their own personal calendar.

- We have listened to our customers and have made changes to our content to make information more consistent and easier to comprehend.

- New text search engine will enable users to search not only articles, but content of PDF documents including forms.

- Ability to share articles, to forward via email, or link to social media sites.

- Utilization of a modern, more flexible development platform to allow the site to continuously improve. The new platform does not restrict the ability to quickly transition to changes in technology such as smart phones, interactive touch screens, etc.

- Map centric applications. On-Line Tools including property and mobile home look up, and supplemental tax estimator have been reengineered to interact directly with Google. Searches will no longer require the taxpayer to know the exact address. Instead, like in Google, taxpayers merely start typing a few characters and a range of possible address matches are provided. In addition, property look up searches can be performed from the home page, eliminating multiple clicks to locate a parcel. Searches can not only be performed by address, APN, but also through Google maps by zooming in to the Google interface and clicking on the desired parcel. All the features of Google are available including street and aerial views.

Attached is a summary of the assessment roll, Proposition 8 data broken down by city, school district and property type and a screen shot of the new website (which is not available until Friday, June 29.)

To download a copy of the current or prior years’ reports, go to https://www.sccassessor.org/index.php/about-us/media-release-current and click on Annual Reports.

View / Download Media Release San Jose Mercury News - June 29, 2012