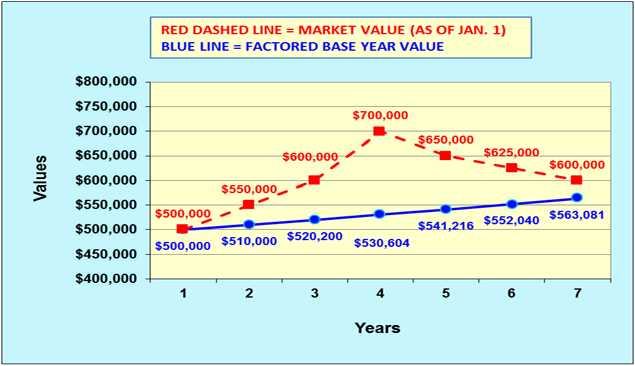

The example below shows when a property owner would not qualify for a temporary reduction.

Typically, this is the case when the market value increases after the property is purchased.

If a property owner purchases their property at fair market value for $500,000 this establishes their base year value at year 1. In year 2, the market value increases to $550,000, but the property owner‘s assessment will still be based on the factored base year value of $510,000 ($500,000 plus 2%) which is lower than the market value.

In this case a property owner would not qualify for a Proposition 8 reduction, the factored base year value is still much lower than the current market value of the property.

Note: Even if the market has gone down, your factored base year value can still be below the current market value for that year as shown in years 5, 6, and 7 below.

The red line: the “market value,” the current market value based on sales of comparable properties as of January 1 of that year.

The blue line: the “factored base year value,” purchase price plus no more that 2% factoring per year..