Granny Units/Accessory Dwelling Units (ADUs)

Whether they are called “Granny” or “In-Law” Units, Accessory Dwelling Units (ADU’s), are one of many solutions chipping away at California’s challenge of providing affordable housing, which has reached crisis proportions in Silicon Valley.

When homeowners contemplate building an ADU, often to realize a second income, they want to know will my property taxes go up? The short answer is yes, but only on the marginal value of the ADU. Assessors throughout California treat ADU’s like a home addition. The existing home will not be reassessed. The most recent changes in laws, as of 2019, do not change the way ADU’s are assessed.

There are a few variations of ADU’s. The most common is a new structure separate from the primary house, typically with a private entrance, kitchen, and bathroom. The new construction on the ADU will be assessed at market value as of the date of completion, or as of the January 1 lien date for partially complete construction.Typically, Assessors use either the cost of construction or a market-based sales comparison to value the new improvements separately. This new assessment is added to the existing assessment.

Homeowners may not want to add a separate “Granny” Unit, but instead prefer to convert a large family room or garage into an ADU. Though no new square footage is added by a conversion, any alterations of the existing living space will be assessed at market value.

For example, if new heating, bathroom, or kitchen fixtures are added, the cost will be added to the existing property tax base of the area that is modified. Other areas of the home untouched will not be reassessed by the Assessor. However, if the area modified is “taken down to stud walls,” making it substantially equivalent to new, it may be reassessed as new.

Whether the addition is for a parent or rented to earn a little extra income, the Assessor’s determination of the new assessed value remains the same, and is treated like any other addition to a home.

Should a homeowner disagree with the Assessor’s new assessed value, there is a simple and free process to dispute the added value. It is always best to start with the Assessor’s staff. An informal review process is available to resolve any factual issues that may exist in the assessment.

It is important that property owners contact the Assessor’s office within 30 days of receipt of the annual, supplemental or corrected assessment notice before deciding to file a formal assessment appeal. Many times, a simple discussion regarding the basis for the Assessor’s decision, the information needed by the Assessor, or to resolve misunderstandings of law is all that is needed.

Related Attachments:

New Construction and Property Taxes Brochure

Related Links:

Authored by Assembly Member Phil Ting, Assembly Bill 551 created the Urban Agriculture Incentive Zones (UAIZ) Act which promotes small-scale commercial or noncommercial agricultural use on vacant, unimproved or blighted lands in urban areas. Adopted in 2013, AB 551 allows cities and counties to create UAIZs, offering preferential property tax assessment to owners of eligible urban lots who agree to enter into a contract restricting the property use to small-scale production of agricultural crops and animal husbandry for a period of five years

REVIEW DUE TO VALUE DECLINE

State law allows the Assessor to temporarily reduce the assessed value of mobile home in certain cases where the fair market value is lower than the assessed value. If this may be the situation for a mobile home you own, request forms are available to view and/or print by clicking below. They are also available by calling or writing the Assessor's Office.

THE DEADLINE TO FILE THIS FORM FOR THE 2025-2026 ASSESSMENT ROLL ENDS AUGUST 1. To apply for a reduction for the 2025-2026 Assessment Roll please visit the Assessor's website after you receive your notification card in June 2025.

Attachements:

About Prop 8

Proposition 8 was passed in November 1978 as an amendment to Proposition 13 and implemented as Revenue & Taxation Code Section 51(a)(2). It annually caps the assessed value of property as of the lien date (January 1) at the lesser of its market value or its factored base year value.

HOW IT WORKS

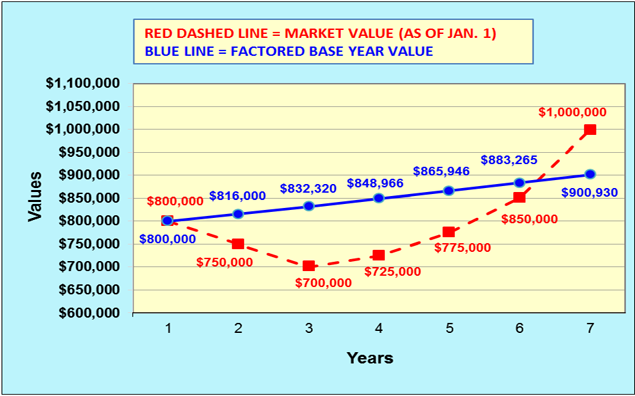

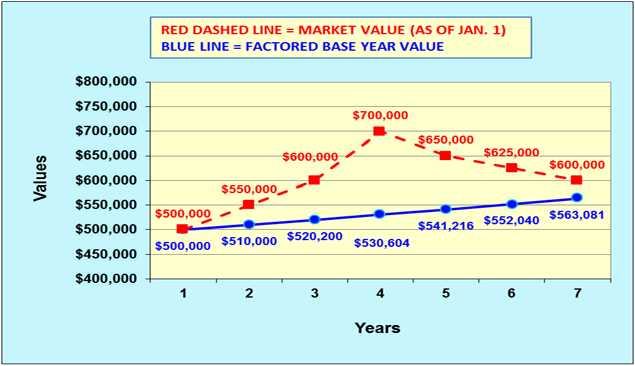

Proposition 8 allows a temporary reduction when the market value of property has fallen below its factored base year value as of the January 1 lien date. Once a Prop 8 reduction has been enrolled, the property’s assessment must be reviewed annually to ensure that the lesser of the market value or the factored base year value is enrolled.

The property’s base year value continues to be factored at a maximum two percent per year, setting its maximum assessed value. As the market recovers the market value of a property will increase based on market conditions which are not restricted to a two percent growth. The value enrolled will follow the market growth rate until the market value exceeds the factored base year value and the lower factored base year is enrolled.

Factored base year value: the value established as of the date of acquisition and/or completion of new construction. This value is adjusted each year by an inflation factor. The inflation factor is the lesser of 2% or the California Consumer Price Index (CCPI) rate.

For more information about factored base year value, see Understanding Proposition 13.

Related Links:

- Decline In Value Request

- Proposition 8 Request for Review Form (printable)

- Mobilehome Proposition 8 Request for Review Form

- How to File a formal appeal of your assessed value, a how to video

- Why Pay When It's Free!

Attachments

As housing supply shrinks, San Francisco, San Jose and Oakland are the nation's three most competitive markets

November 16, 2017 -- The median price for a single-family home in the nine-county Bay Area region climbed to $892,720 - up 11.1 percent year-over-year - and eclipsed the prior record of $752,000 set in June 2016, even as short supply drove down the number of homes sold. In May 2015, the Bay Area median was $700,000.

In Santa Clara County, the median was $1,242,500, up 18.6 percent over last year.

Bay Area homes: Bay Area home prices reach record highs, but sales tumble

May 24, 2017 -- The median price for a previously owned single-family home in the nine-county Bay Area region climbed to $800,000 — an all-time high — and eclipsed the prior record of $752,000 set in June 2016, even as short supply drove down the number of homes sold. In May 2015, the Bay Area median was $700,000.

The price for the typical previously owned home was $1,050,500 in Santa Clara County.

Click here to read full article: Bay Area home prices reach record highs, but sales tumble