Assessed Value Increases 7.9%; Commercial and Industrial drives increases

Santa Clara County Assessor Larry Stone announced today that the county’s net assessment roll increased by 7.9 percent to $419 billion, an increase of $30.9 billion, a virtual tie with last year. The assessment roll growth during the past four years has exceeded the growth for the preceding ten years. The assessment roll is a snapshot of the assessed value of all real and business personal property in Santa Clara County as of the January 1, 2016 lien date.

“Silicon Valley’s strong economy has erased most of the losses in property values incurred during the ’Great Recession’,” said County Assessor Larry Stone. “That’s great news for all property owners, as the largest single asset that most people own is their home. Santa Clara County is once again leading the region, and the state.”

“The Silicon Valley economy is the envy of the nation, posting 60 consecutive months of job gains. Unlike the previous jobless recovery, unemployment dropped to 3.8% in Santa Clara County, the sixth consecutive month below 4%, lower than the state at 5.4% and the nation at 5%. The valley’s growth has been driven primarily by the high technology industry.”

Proposition 8 was passed in November 1978 as an amendment to Proposition 13 and implemented as Revenue & Taxation Code Section 51(a)(2). It annually caps the assessed value of property as of the lien date (January 1) at the lesser of its market value or its factored base year value.

HOW IT WORKS

Proposition 8 allows a temporary reduction when the market value of property has fallen below its factored base year value as of the January 1 lien date. Once a Prop 8 reduction has been enrolled, the property’s assessment must be reviewed annually to ensure that the lesser of the market value or the factored base year value is enrolled.

The property’s base year value continues to be factored at a maximum two percent per year, setting its maximum assessed value. As the market recovers the market value of a property will increase based on market conditions which are not restricted to a two percent growth. The value enrolled will follow the market growth rate until the market value exceeds the factored base year value and the lower factored base year is enrolled.

Factored base year value: the value established as of the date of acquisition and/or completion of new construction. This value is adjusted each year by an inflation factor. The inflation factor is the lesser of 2% or the California Consumer Price Index (CCPI) rate.

For more information about factored base year value, see Understanding Proposition 13.

Related Links:

- Decline In Value Request

- Proposition 8 Request for Review Form (printable)

- Mobilehome Proposition 8 Request for Review Form

- How to File a formal appeal of your assessed value, a how to video

- Why Pay When It's Free!

Attachments

The Assessor annually sends Notifications of Assessed Value at the end of June, notifying property owners of the intended assessed value for that roll year. It provides property owners the opportunity to compare that assessment to their opinion of market value as of January 1. If the assessed value is greater than the market value of the property as of January 1, the property owner may request a review for a Prop 8 temporary reduction. There are two separate review processes: Informal Review and Formal Appeal/Assessment Appeals Application.

If you did not receive the Notification of Assessed Value Letter after the second week of July, you can request a duplicate notice be mailed to you by requesting online, contacting the Santa Clara County Assessor’s Office at This email address is being protected from spambots. You need JavaScript enabled to view it. or 408-299-5500.

Informal Review

- The Notification of Assessed Value is mailed last week in June

- The filing period starts June 30 and ends on Aug 1

- The Assessor’s Office reviews Prop 8 requests through August 15. The results of the reviews are sent shortly after August 15.

Regardless of the result of the Assessor’s review, the property owner is entitled to file an Assessment Appeals Application. It is the property owner’s responsibility to timely file an Assessment Appeals Application if dissatisfied with the Assessor’s informal review.

Formal Appeal or Assessment Appeals Application

- An Assessment Appeals Application can be filed through the Clerk of the Board between July 2 and September 15 (or, if September 15 falls on a weekend, the following Monday)

- The Assessment Appeals Application is available from the Clerk of the Assessment Appeals Board via their website or you can contact them directly at 408-299-5088, for more information

Assessment Appeals can take up to two years to resolve. Once an application is submitted, the assigned appraiser may contact the applicant to discuss the appeal.

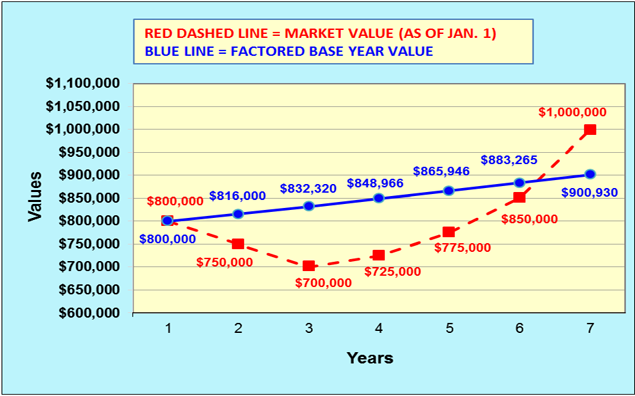

The example below shows when a property owner would qualify for a temporary reduction.

In the example a property owner purchases a property at fair market value for $800,000 establishing the base year value at year 1. On the subsequent lien date (year 2), the market value decreases to $750,000, but the property owner‘s assessment is based on the factored base year value, $816,000 ($800,000 plus 2%) which is higher than the market value. Therefore, the property owner would qualify, under Prop 8, for a temporary reduction to $750,000.

In this case, the property owner would qualify for a Proposition 8 reduction, for years 2 through 6, but not in year 7.

Note: In year 7, the factored base year value, $900,930, would be reinstated and the property owner would not qualify for relief under Prop 8

The red line: the “market value,” the current market value based on sales of comparable properties as of January 1 of that year.

The blue line: the “factored base year value,” purchase price plus no more that 2% factoring per year.

The example below shows when a property owner would not qualify for a temporary reduction.

Typically, this is the case when the market value increases after the property is purchased.

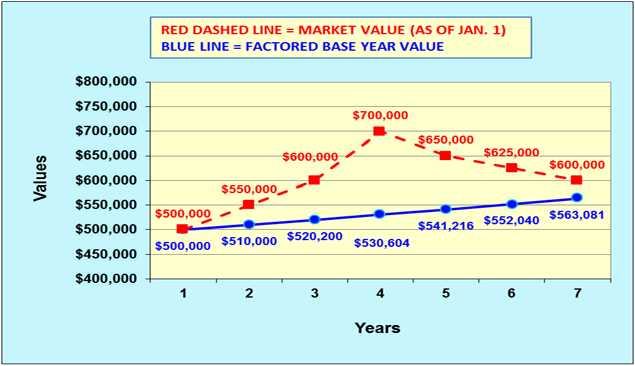

If a property owner purchases their property at fair market value for $500,000 this establishes their base year value at year 1. In year 2, the market value increases to $550,000, but the property owner‘s assessment will still be based on the factored base year value of $510,000 ($500,000 plus 2%) which is lower than the market value.

In this case a property owner would not qualify for a Proposition 8 reduction, the factored base year value is still much lower than the current market value of the property.

Note: Even if the market has gone down, your factored base year value can still be below the current market value for that year as shown in years 5, 6, and 7 below.

The red line: the “market value,” the current market value based on sales of comparable properties as of January 1 of that year.

The blue line: the “factored base year value,” purchase price plus no more that 2% factoring per year..