On November 3, 2020, voters approved Proposition 19 (Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act), which makes sweeping changes to a property owner’s ability to transfer their Proposition 13 Assessed Value. Those changes included broad provisions that superseded prior laws for transferring the assessed value to another home (e.g. Proposition 60 and 90). Both Proposition 60 and 90 expired on March 31.

On November 3, 2020, voters approved Proposition 19 (Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act), which makes sweeping changes to a property owner’s ability to transfer their Proposition 13 Assessed Value. Those changes included broad provisions that superseded prior laws for transferring the assessed value to another home (e.g. Proposition 60 and 90). Both Proposition 60 and 90 expired on March 31.

Proposition 19 was hastily passed by the legislature in less than a week and put on the November 2020 ballot. While it changed the state constitution it did not provide implementing statutes. Moreover, portions of the approved language changes are ambiguous, unclear and/or conflicting. As a result, Santa Clara County Assessor Larry Stone was appointed by the California Assessors’ Association (CAA), to an ad-hoc committee of the CAA to help bring clarity to how Proposition 19 will be implemented uniformly by Assessors Statewide. The committee has enlisted subject matter experts and attorneys throughout California and is working closely with the Board of Equalization to provide guidance and where necessary passage, on an urgency basis, of implementing statutes and binding Board of Equalization rules.

In the absence of Rules and implementing Statutes the Assessor, as of April 1, 2021 is implementing Proposition 19 as described below.

Summary

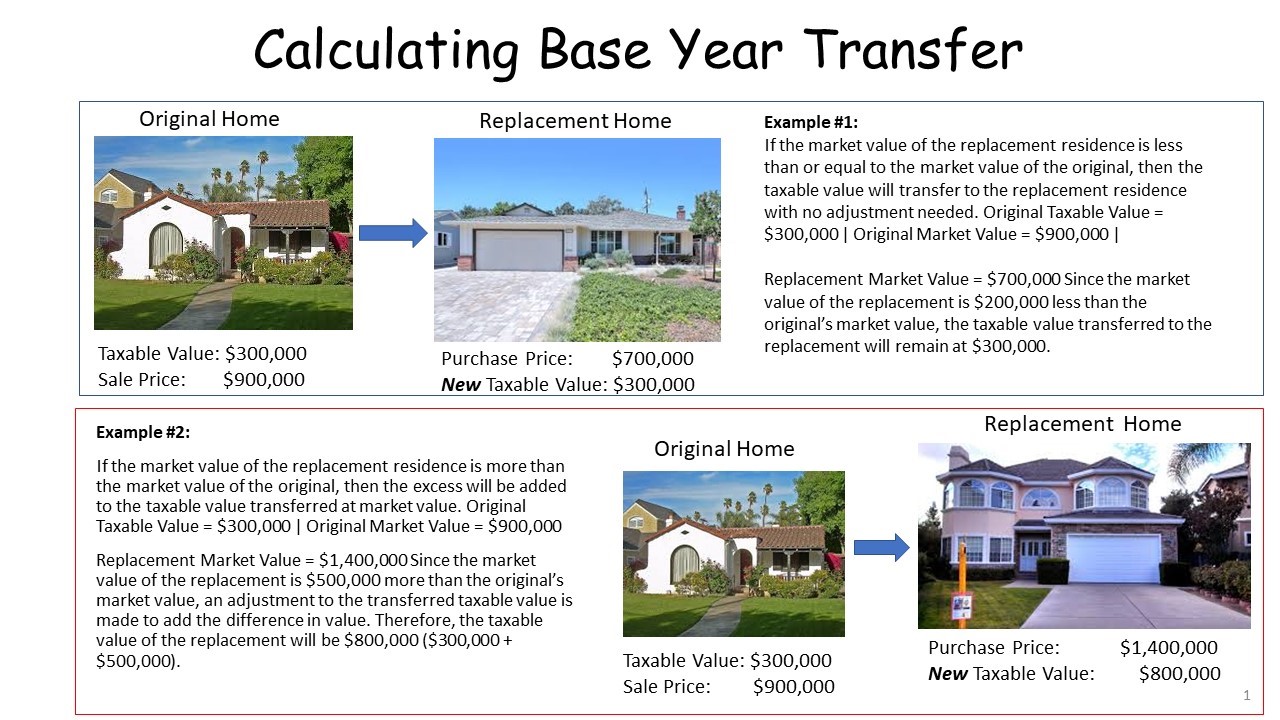

Effective April 1, 2021, Proposition 19 permits eligible homeowners (defined as over 55, severely disabled, or whose homes were destroyed by wildfire or disaster) to transfer their primary residence’s property tax base value to a to a newly purchased or constructed replacement residence of any value, anywhere in the state. The base year value may be transferred to a home of equal or lesser value. However, if the value of the replacement home is greater than the value of the original property, the difference in market values is be added to the transferred base year value. To see an estimate go to the Assessor’s Base Year Transfer Calculator.

Do I Qualify?

To qualify for a Prop 19 tax base transfer, a few criteria must be met. First, either the claimant or claimant’s spouse must be age 55 or older when the original residence is sold. Second, the replacement residence must be purchased within two years either before or after the current residence is sold. Third, one of the transactions must occur on or after April 1, 2021.

If both your sale and purchase were prior to April 1, 2021, you may file for the exclusion under Proposition 60/90 base year transfer rules; however, you are not eligible for the exclusion under the new Proposition 19 rules.

The requirements, as of April 1, 2021, for Proposition 19 exclusion include, but are not limited to:

- The principal claimant or the claimant's spouse who resides with the claimant must be at least 55 years of age at the time the original residence is sold.

- The claimant must be an owner on record of both the original and replacement residences.

- The replacement residence must be purchased or newly constructed within two years either before or after the sale of the original residence. The purchase or new construction of the replacement dwelling must include the purchase of that portion of land on which the replacement dwelling will be situated. One of the two transactions must occur on or after April 1, 2021.

- The sale of the original residence must qualify for reassessment under the provisions of California Revenue and Taxation Code Section 110.1

- The principal claimant must have ONE of the following on both the original and replacement residences:

✓ Received, or was eligible for, a Homeowner's Exemption

OR

✓ A California homeowner can receive the benefit a total of three times, except for certain circumstances regarding severely disabled persons and disasters.

- Claims must be filed within three years from the date the replacement residence is purchased or newly constructed to receive full relief. Claims filed after the three-year time period will receive Prospective Relief only. You must complete the claim form and provide evidence and/or declare under penalty of perjury that you are at least 55 years of age.

- Special rules apply to multi-unit dwellings and mobile homes and more information is available in the FAQ. Alternatively, please email our office at https://www.sccassessor.org/index.php/about-us/about-our-accessor/email-the-assessor-s-office or contact us at 408-299-5300.

How Do I Apply?

Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located. A non-refundable processing fee of $110 is required in Santa Clara County. Checks should be made out to County of Santa Clara. Credit card payments for the processing fee are accepted in person at our office. We accept VISA, Mastercard, Discover, and American Express.

The anticipated time to process transfers will likely be delayed due to Assessor’s throughout California adapting to the new law. Processing of applications in Santa Clara County may additionally be hindered due to delays in receiving valuation certification information from other Counties. Applications are processed on a flow basis.

You may download the form here:

Base Year Transfer to Replacement Home, Age 55+ (Proposition 19), BOE-19-B

FAQ

For a list of commonly asked question and answers go to FAQ - Proposition 19

Calculating the Transfer, an Example

Proposition 19

Additional Information about Proposition 19, including the current guidelines or status of changes in the law or rules are available at https://www.sccassessor.org/index.php/tax-savings/transferring-your-assessed-value/prop19 or https://www.boe.ca.gov/prop19/#Introduction

Disclaimer

This information is intended to provide a general summary of Proposition 19. It is not intended to be a legal interpretation or official guidance, or relied upon for any purpose, but is instead a presentation of summary information. Proposition 19 is a constitutional amendment, so additional legislation, regulations, and statewide guidance are expected to clarify its implementation. If there is a conflict between the information provided here and the proposition or any legal authorities implementing or interpreting the proposition, the text of the proposition and the other implementing or interpretive authorities will prevail. Please continue to visit our website or the website of the State Board of Equalization for more information. We encourage you to consult an attorney for advice on your specific situation. The advice below is subject to change.