Proposition 19, A conversation with Assessor Larry Stone—March 11, 4:00 PM

On March 11 at 4:00 PM, Assessor Larry Stone will participate in a live, interactive conversation with San José Spotlight Board Chair Perla Rodriguez.

California voters in 2020 approved Proposition 19, also known as The Home Protection for Seniors, Severely Disabled, Families, and Victims of Wildfire or Natural Disasters Act, which significantly complicated the rules for transferring property tax assessments.

Free to the public, residents and especially homeowners are encouraged to sign up and attend, via Zoom.

Date March 11

Time: 11:00-12:30pm

https://us02web.zoom.us/webinar/register/WN_w8eWWt8QR0iDwLGeIPRDbQ.

The forum is another segment in a series of San Jose Speaks conversations organized by San Jose Spotlight. San José Spotlight is the city’s first nonprofit news organization dedicated to independent political and business reporting.

Assessor Larry Stone

invites

Homeowners, Realtors, and Title Company Representatives

to a

Proposition 19 Workshop

THE LINK TO WATCH A YOUTUBE VIDEO OF THE WORKSHOP IS AT: https://youtu.be/a1DKLbjQ7yo. AT THE BOTTOM OF THIS PAGE ARE LINKS TO THE POWERPOINT SLIDES

Interest in Proposition 19, administered by Assessors and the Board of Equalization (BOE), has been heightened due to the absence of implementing statutes, as the Initiative was rushed through the legislature in just 6 days last June. As a result, many of the provisions of Proposition 19 are confusing, ambiguous, and conflict with intent language.

The Webinar is designed to help educate real estate professionals, realtors, title representatives and others about the significant changes to the state constitution and is open to homeowners as well. There is no charge to attend.

The workshop will be focused principally on base year transfers (Previously Prop. 60/90), the second portion of the initiative. Championed by the California Association of Realtors, it increases portability of a qualifying homeowner’s assessed value and becomes effective on April 1, 2021. This portion of the Initiative expands benefits allowed for seniors, disabled, and victims of disasters seeking to transfer their assessed value to another home anywhere in California.

In addition to a formal PowerPoint presentation led by Assessor Stone and assessment professionals, a significant portion of the Webinar will be set aside for a live questions and answer session. The Assessor will also discuss the current status of implementation efforts by Assessors, actions by the BOE, and the status of implementing statutes and rules

To register for the workshop, go to:

THE LINK TO WATCH A YOUTUBE VIDEO OF THE WORKSHOP IS AT: https://youtu.be/OYPRccZPUr4. AT THE BOTTOM OF THIS PAGE ARE LINKS TO THE POWERPOINT SLIDES

Assessor to Lead “Zoom” Workshop on New Parent-Child Transfer Law

“Implementing Proposition 19”

On Thursday, February 4 at 1:30pm, in partnership with the California Lawyers Association and Board of Equalization Member Malia M. Cohen, Santa Clara County Assessor Larry Stone is hosting a workshop on Proposition 19 to help parents (and grandparents), who plan to leave property to their children, understand how the assessor’s office will implement Proposition 19. The on-line webinar is targeted toward estate and tax attorneys and financial planners. There is no charge to attend.

Date: Thursday, February 4, 2021

Time: 1:30-2:30pm

Registration link: https://calawyers.org/event/prop-19-seminar

Participants include Assessor Larry Stone, Board of Equalization Member Malia M. Cohen, Nora Galvez, a member of the Santa Clara County assessor’s senior management team, and one of the State’s leading assessment experts on transfers and Board of Equalization Tax Counsel, Richard Moon. The session will be moderated by Ellen McKissock, co-chair of Hopkins & Carley’s Trust & Estate Litigation Practice and Chair of the Trusts & Estates Section of the California Lawyers Association. Attached are their biographies.

The workshop is being organized to discuss the status of Proposition 19 implementation by assessors and the Board of Equalization, including the status of urgency legislation.

“Many of the provisions of the Proposition 19 are confusing, ambiguous, and conflict with the initial intent,” said Stone. “Proposition 19 was rushed through the Legislature in just six days at the end of the legislative session.”

A special committee of the California Assessors’ Association, led in part by Santa Clara County Assessor’s Office, has been meeting with subject matter experts and attorneys from assessors’ offices and the Board of Equalization. “It’s a mess and an embarrassment that we are trying to sort out,” said Stone.

The workshop will focus on the aspects of Proposition 19 which, on February 16, replaces California’s Parent-Child Exclusion (Proposition 58/193). The changes to the California Constitution significantly narrow what properties can be transferred without reassessment. The initiative also expands benefits for seniors, disabled property owners and victims of disasters to transfer their assessed value to another home in any California county.

Following introductory remarks by Board of Equalization Member Malia M. Cohen, Silicon Valley’s Assessor Larry Stone, will discuss the current status of implementation efforts by assessors, actions by the Board of Equalization, and urgency legislation under consideration. This workshop will focus exclusively on the changes to the parent and child exclusions that must be implemented on February 16. A substantial detailed presentation will be provided by subject matter experts, followed by a robust Q&A session.

During the workshop, Assessor Stone, along with subject matter experts from his office, will address many of the common questions raised by estate professionals about the new law. In addition, they will provide an update on new compliance forms, how Proposition 58/193 will be phased out, what major ambiguous issues have been resolved thus far, and how the assessor may address vague provisions not resolved by the State Legislature.

To register for the workshop, go to https://calawyers.org/event/prop-19-seminar/. Participants are encouraged to submit, non-property specific questions in advance.

The purpose of this webinar is to provide general insights regarding the implementation of Proposition 19. It is not intended to be a legal interpretation or official guidance. Taxpayers are encouraged to consult an attorney for advice.

Shortly following the workshop, the entire webinar and PowerPoint presentations will be made available on the Assessor’s website at www.sccassessor.org.

Related Attachments

After February 15, new law goes into effect

Voters End 35-year Inheritance Property Tax Break

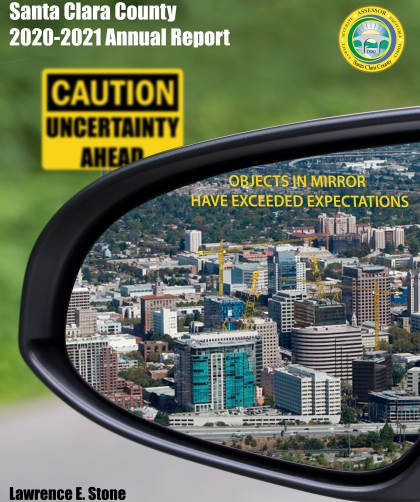

Every year we work to continuously improve the report and if you have suggestions please do not hesitate to let our office know.