The annual report has gone fully digital! To see the fun new interactive version of the report go to: Annual Report 2019- 2020 . As always the report is available in a PDF, which you can download below.

Every year we work to continuously improve the report and if you have suggestions please do not hesitate to let our office know.

Below are links to each of the above articles:

South Valley Magazine:

San Jose Mercury News:

https://www.mercurynews.com/2020/06/04/coronavirus-lockdowns-no-match-for-bay-area-home-buyers

Barrons

https://www.barrons.com/articles/sellersparticularly-in-the-higher-endreturn-to-market-01591021701

San Francisco Chronicle

Silicon Valley/San Jose Business Journal

https://www.bizjournals.com/sanjose/news/2020/05/28/san-jose-home-sales-increasing-covid-impact.html

San Jose Spotlight

https://sanjosespotlight.com/in-pricey-silicon-valley-homebuyer-perceptions-not-prices-have-changed/

Bloomberg

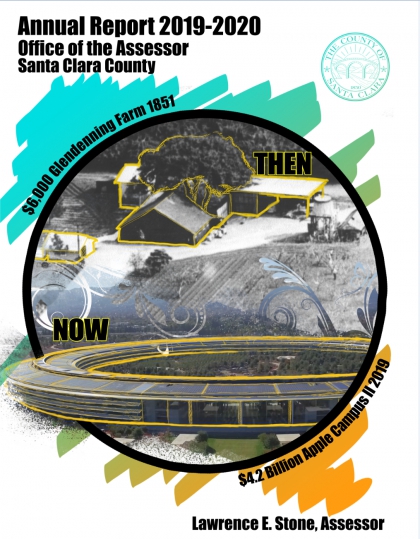

On July 1, 2020, County Assessor Larry Stone delivered the annual assessment roll to the Santa Clara County Finance Agency Director reflecting the assessed value of all property as of the lien (valuation) date, January 1, 2020. The total net assessed value of all real and business property grew by $35.5 billion to a total of $551.5 billion, a 6.87% increase over the prior year. “There is little doubt that the 2020 assessment roll captures the peak of the longest economic boom in Silicon Valley’s history,” said Assessor Larry Stone. Since the Great Recession, the assessment roll has grown by $255.5 billion. This year’s growth in assessed value was led by the cities of Sunnyvale and Mountain View with 10.37% and 8.99% growth, respectively. Saratoga and the unincorporated areas of the County recorded the smallest year over year growth of 4.34% and 2.64%, respectively.

The major beneficiaries of property tax revenue are public schools, community colleges, cities, and the County. Fifty percent of local property tax revenue generated in Santa Clara County goes to fund public education. “From teacher salaries to books to laptops, Fremont Union High School District depends almost entirely upon revenue from property taxes” said Bill Wilson, Vice President of the Fremont Union High School District Board of Trustees.

“Since property assessments are based upon market value of property as of January 1, I fully expect this year will be a transition year,” said Stone. “Next year will not be as positive, as we will be considering the full economic impact of COVID-19 on real estate values,” he said.

Assessments this year are based upon transactions between January 1, 2019 and January 1, 2020. “Earlier this year, I advised schools and local government officials that there were signs of a decline in the same geographic areas. It was becoming clear the economic boom of the past 10 years was not sustainable, and that the 2020 assessment roll would reflect the apex of 10 consecutive years of economic prosperity.”

“I had hoped for a gradual decline. Instead the pandemic-triggered recession, and the political chaos that followed, has created the worst economic crisis since the Great Depression. I expected the next recession would be a ‘normal’ recession, a ‘soft landing’. Unfortunately, we are facing a ‘crash landing’, that one analyst described as like being in a wheelchair pushed down a very long flight of stairs.”

The 2020 assessment roll captures the market value of transactions as of January 1, following a period of exceptional economic growth, in which the Silicon Valley unemployment rate hit a record 2.3%. Assessor Roll Close 2020 Media Release Page 2 of 3 July 1, 2020 New construction of major commercial and multi-family housing projects accounted for 17.5% of the total increase in assessments. Property acquisitions and developments by Google, Adobe, megadeveloper Jay Paul, and others in San Jose’s urban core, contributed significantly to assessment growth. The assessment of business property, i.e. machinery, equipment, computers, and fixtures grew by 5.27%, topping $40.6 billion. The final component of assessment roll growth is the 2% increase in the assessed value of all properties mandated by Proposition 13.

Despite Pandemic Assessment Roll Delivered On-Time

“The pandemic caused shelter-in-place order pushed our organization to new levels of performance. The work of dedicated assessment professionals is critical not only for schools and cities, but also for funding essential first-responders and healthcare workers in their effort to defeat COVID 19,” said Stone. Despite the shelter-in-place order, the Assessor’s Office has continued to provide on-line and telephone customer service to taxpayers.

Requesting a Temporary Reduction in Assessed Value

“As Assessor, my responsibility is to insure that accurate values are enrolled to reflect market conditions. When market value (as of the lien date, January 1, 2020) falls below the existing assessment, my office is required to temporarily reduce the assessed value to reflect the declining market value,” said Stone. “This year my appraisers reduced assessed values on a modest number of properties for a total reduction of $875 million. Next year, post-Covid, could be a very different story. “There is little doubt on January 1, 2021, the market value of many commercial properties will be eligible for significant temporary reductions,” said Stone.

“The picture is less clear for residential property,” said Stone. The market value of single-family homes has actually increased 5% year-over-year, according to Multiple Listing Service. The culmination of fewer homes for sale and lower interest rates have buoyed the residential market.

Property owners who demonstrate their assessed value is higher than the market value of their property are encouraged to request an informal review of their assessment. The appraisal staff will complete as many informal reviews as possible prior to August 1, the deadline for making changes that will be reflected on the property tax bill mailed in the fall. To apply for a reduction go to www.sccassessor.org/prop8.

The Assessor’s Office has a brief two-minute video that answers the question, “why assessed values for most properties have not declined this year”. The video can be accessed at https://youtu.be/kFC2X0cG-qY.

Annual Notification of Assessed Value

On June 30, the Assessor’s Office mailed annual assessment notices to 493,000 property owners, reporting each property’s 2020 assessed value. The notice serves as the basis for the property tax bill mailed in the fall. Santa Clara County is one of only nine counties in California which provides early notice to all property owners. “Most property owners in California learn of their assessed value for the first time when they receive their property tax bill in October,” said Stone.

The County Finance Agency has an on-line tool to help property owners learn exactly how much of their property taxes go to neighborhood public schools, community colleges and government agencies, including the 15 cities and County government.

Property owners who disagree with the assessed value printed on the notice are encouraged to take advantage of the Assessor’s “online tool,” available 24/7, enabling property owners to review the sale of comparable properties used to determine their assessment. This interactive service modeled after Assessor Roll Close 2020 Media Release Page 3 of 3 July 1, 2020 online banking, the Opt-In Tool, allows taxpayers to securely receive assessment notices, in addition to interacting with the Assessor’s Office electronically rather than by mail, telephone, or in person. To access the data, a property owner must have a username and password created last year, or the PIN listed on the annual assessment notice. To login go to: https://www.sccassessor.org/index.php/emailopt-in/manage-your-account.

The annual notice also describes the process for filing a formal assessment appeal by the September 15, 2020 deadline. Residential property owners who decide to file a formal appeal, are encouraged to request their appeal be adjudicated by an independent residential Value Hearing Officer (VHO), rather than the more formal three-member Assessment Appeals Board. VHO hearings are scheduled frequently, allowing a more rapid resolution.

“Property owners who disagree with the assessed value should not wait for the tax bill before filing an appeal, as the tax bill is mailed by the Tax Collector after the assessment appeal filing deadline,” said Stone. More information is available from the Clerk of the Board by calling (408) 299-5088, or going to their website:http://www.sccgov.org/assessmentappeals.

More information about the Assessor’s Office is available at www.sccassessor.org.

The annual report has gone fully digital! To see the fun new interactive version of the report go to: Annual Report 2019- 2020 . As always the report is available in a PDF, which you can download below.

Every year we work to continuously improve the report and if you have suggestions please do not hesitate to let our office know.