Every year we work to continuously improve the report and if you have suggestions please do not hesitate to let our office know.

Every year we work to continuously improve the report and if you have suggestions please do not hesitate to let our office know.

Assessment Roll grows 5.4 percent despite few residential transactions and troubled commercial real estate market, says Assessor Larry Stone

2024 Assessment Roll Growth at $35.6 billion, driven by residential appreciation and Prop. 13 inflation factor (2 percent)

Santa Clara County, California, July 8, 2024 – This year’s annual assessment roll reflects the complex and unpredictable status of both the region’s residential and commercial property markets. Residential properties experienced a decline in value in 2023, rebounded in 2024, and are now the highest in the country. The number of residential change of ownership transactions continued to decline, but higher values countered the negative impact.

Commercial property sales are volatile and new construction of commercial properties came to a halt. However, the global attraction of the region remains strong. The full impact of these factors on the assessment roll is expected to be clearer in future years.

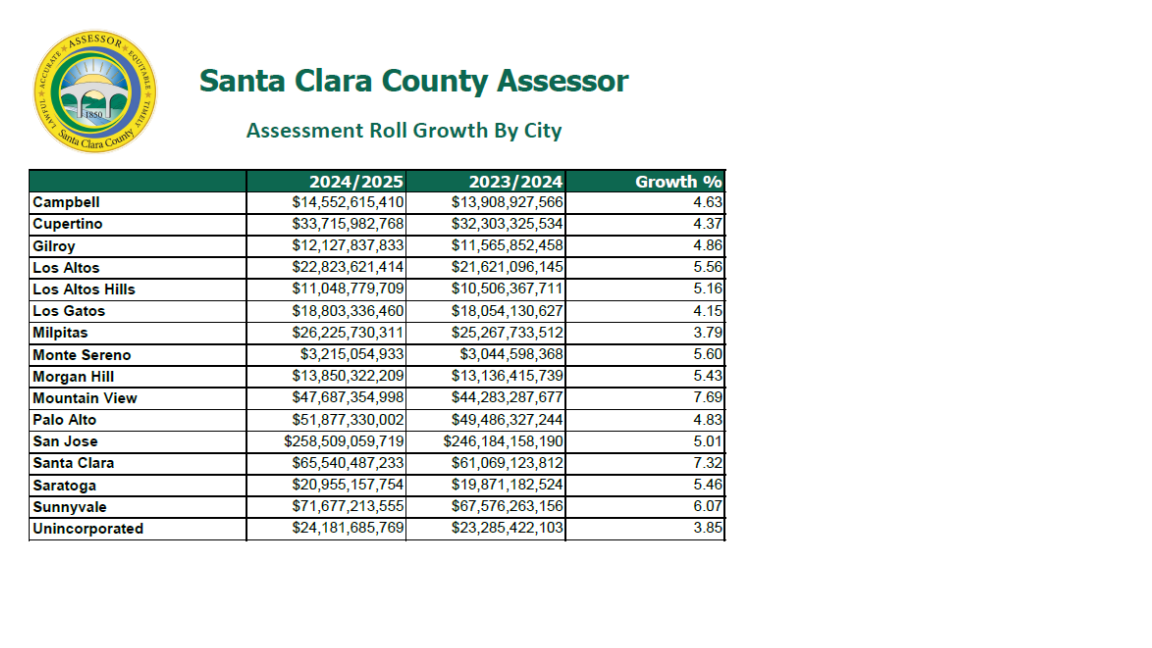

The 2024-2025 assessment roll is comprised of the total net assessed value of all real and business property in Santa Clara County as of the January 1, 2024 lien date, and reflects changes between January 1 and December 31, 2023. The value of this year’s roll reached a new height of $696.8 billion, a surprising 5.39 percent increase over the prior year.

The leading contributors to the increase in roll growth are changes in ownership, application of the annual two percent inflation factor, and new construction, which accounted for over $14.9 billion, $10.6 billion and $5.9 billion, respectively. Business Property values added an additional $2.2 billion.

Consumer spending is the primary driver of the U.S. economy. In 2021, the economy came roaring out of the COVID recession. Robust consumer spending combined with widespread product and worker shortages created the highest inflation in 40 years.

Changes in property ownership accounted for 42 percent of this year’s increase. In early 2023 the real estate markets cooled from 2022 record levels. Interest rates increased, the number of transactions declined, and market values stabilized. In response, the Assessor proactively reduced the assessments of 17,000 residential properties in 2023.

In 2024, residential property values “surged” and the assessed values of more than half of the properties in Proposition 8 (Prop. 8) decline status were fully restored. The other half were partially restored or received additional reductions.

Proposition 13 limits the assessment of properties without new activity or transactions to the California Consumer Price Index (CCPI) or two percent, whichever is lower. The final component of the 2024-2025 assessment roll growth is the two percent increase in the assessed value of those properties, adding $10.6 billion to the assessment roll. “Even when real estate values are soaring, Proposition 13 limits the increase in assessment to two percent, a significant financial benefit to most property owners,” said County Assessor Larry Stone.

“As Assessor, my responsibility is to ensure that accurate values are enrolled based upon market conditions. When market value (as of January 1, 2024) falls below the existing assessment, my office is required by law to temporarily reduce the assessed value to reflect the declining market value. Each year, my office proactively reviews the value of all residential property in the County to determine the accurate assessment. When property owners receive their Notification of Assessed Value (NAV) card in the mail or electronically, they have an opportunity to review their assessed value and compare it to the market data we use to make the assessment. If they believe their property meets the criteria for a Prop. 8 reduction, they can apply for an informal review,” said Stone.

This year’s roll includes 11,226 properties in decline status. The net Prop. 8 restorations added $1 billion to this year’s roll.

Technological innovation continues to generate significant investment in Silicon Valley. However, in 2023, the number of venture capital deals plummeted by 44 percent, and the money raised was at the lowest level in ten years.

Rising vacancy rates, declining rental rates, the absence of big leasing deals, and the continuation of hybrid and remote working, have driven the office vacancy rate in Silicon Valley to over 20 percent.

An increasing number of office buildings are selling for less than assessed value and foreclosures due to delinquent loans are becoming more frequent. “Ninety-eight percent of the $115.2 billion of assessed value currently under appeal involves commercial property. We expect to receive a greater number of commercial property assessment appeals filed this year, which may result in assessment roll corrections reducing the value of the assessment roll.”

When an assessment appeal is filed, the County must reserve against the value at risk, further reducing available funds for essential government services.

New construction is a core component of assessment growth. Several large-scale construction projects were completed, contributing $5.9 billion in new construction. Apartment buildings continue to generate significant investment in the region, including $4.7 billion of apartment building acquisitions. High-value examples include The Martin Apartments in Cupertino, adding $256.4 million to the assessment roll, and the Related California 5150 Calle Del Sol project in the City of Santa Clara which added $202.8 million to the roll, boosting the City’s assessment roll growth to 7.32 percent, the second highest growth in the County.

While some projects already under construction moved forward, plans for commercial new construction have stalled, changed, or been considered for conversion to housing. Platform 16, a 1.1 million square foot Class A office building in San Jose, halted construction for the second time since breaking ground in March of 2020. The company is committed to completing the project as the market improves. There has been widespread speculation that the high-profile Google Downtown West project in San Jose was in jeopardy of proceeding. However, recently Google announced they are committed to the project, announcing plans in February to demolish a building and conduct preliminary work in advance of eventual construction.

The near-term impact of reduced property sales and values, as well as changes in stalled construction plans, are likely to result in reduced assessment roll growth in the years ahead.

The long-term outlook for the region, however, is good. With 80 percent of all tech R&D occurring in Silicon Valley and the headquarters of three, trillion-dollar companies – Apple, Microsoft, and NVIDIA – the global attraction of the region will not change anytime soon.

The assessment of “business property,” i.e. machinery, equipment, computers, and fixtures, recorded an increase of 4.9 percent to $49 billion. Santa Clara County historically has the second-largest business property values in California.

Though the majority of homeowners enjoy relatively low assessments compared to the market value of their properties due to Prop. 13, it comes at a cost to schools and local governments dependent on the revenue necessary to fund quality education and public services.

The 2024-2025 assessment roll is a snapshot of property values as of January 1, 2024. “While residential property values have stabilized recently, high mortgage interest rates and inflation have reduced consumer buying power. With office vacancy increasing due in part to remote work, and the residential sales decreasing, the volatile and unpredictable nature of Santa Clara County real estate causes concern for the future of property values,” said Stone.

Beneficiaries of property tax revenue

The major beneficiaries of property tax revenue are public schools, community colleges, cities, special districts, and Santa Clara County. Fifty percent of local property tax revenue generated in Santa Clara County goes to fund public education. To find out more about property tax, visit the “Property Tax Story” on the County data pages.

Annual Notification of Assessed Value (NAV)

On June 28, the Assessor’s Office mailed annual Notification of Assessed Value (NAV) Cards to 498,347 properties, reporting each property’s 2024 assessed value. The notice serves as the basis for the property tax bill. Santa Clara County is one of only 11 counties in California that provides early assessment notice to property owners. “Most property owners in California learn of their assessed value for the first time when they receive their property tax bill in October,” said Stone.

Requesting a Temporary Reduction in Assessed Value

Property owners who can demonstrate their assessment is higher than the market value of their property (as of January 1, 2024) are encouraged to request an informal review of their assessment no later than August 1. “My appraisal staff will complete as many informal reviews as possible before August 15, the deadline for making adjustments that will be reflected on the property tax bill mailed in the fall,” said Stone. To apply for a reduction, go to www.sccassessor.org/prop8.

Assessment Appeals

The annual notice also describes the process for filing a formal assessment appeal by the September 15, 2024 deadline. Residential property owners who decide to file a formal appeal, are encouraged to request their appeal be adjudicated by an independent residential Value Hearing Officer (VHO). VHO hearings are scheduled frequently, allowing for a more rapid resolution.

“Property owners who disagree with the assessed value should not wait for the tax bill before filing an appeal, as the tax bill is mailed by the Tax Collector after the assessment appeal filing deadline,” said Stone. More information is available from the Clerk of the Board by calling (408) 299-5088, or going to their website: https://www.sccgov.org/assessmentappeals.

Go Paperless

The paperless option allows taxpayers to securely receive assessment notices electronically. To register, a property owner must have the PIN listed on the annual Notification of Assessed Value or their log-in credentials if they are already registered. To sign up or log in go to: Manage Account Page

February 21, 2024 Potential Tax Relief for Commercial Property Owners, Opens Review of Assessed Value Early

Santa Clara County, January 23, 2024: Assessor Larry Stone announced that he will not appeal a recent California Superior Court decision in favor of the 49ers in Stone v. Santa Clara County Assessment Appeals Board No. 1. In that case, Assessor Stone challenged an administrative ruling by the local Assessment Appeals Board (AAB) that reduced the original assessment of the 49ers' interest in Levi’s Stadium by nearly half.

“Many people think I sued the 49ers, but that is not the case,” clarifies Stone. “My legal challenge is with how the AAB reached its decision. I believe that the AAB’s ruling did not take into consideration the value of all of the 49ers’ private interests in the stadium, which allowed the 49ers to generate significant revenue not only from sporting events, but also concerts, corporate conferences, and retail and restaurant spaces.” said Stone. “How can you ignore the benefits to the 49ers when the stadium hosts a Taylor Swift concert or an international soccer game?”.

Consumer spending is the primary driver of the U.S. economy. Suddenly, the economy came roaring out of the COVID recession. Robust consumer spending combined with widespread product and worker shortages created the highest inflation in 40 years. Consumers couldn’t stop spending and prices wouldn’t stop rising .

The Superior Court denied the challenge, finding that the process the AAB used to come to its decision was appropriate, and left in place the AAB’s ruling that the 49ers should pay tax on only half the value of the stadium. Although Assessor Larry Stone disagrees with the outcome of the case, he will not pursue an appeal of the Court’s decision.

“I believe we made the correct assessment of the stadium, and I stand behind the work of the expert certified appraisers on my staff,” says Stone, “but the result, on balance, does not merit an appeal, so we accept the decision of the court.