On November 3 voters approved Proposition 19 (Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act), which makes sweeping changes to a property owner’s ability to transfer their Proposition 13 Assessed Value. The measure generally expands a qualifying homeowners ability to transfers their assessed value and narrows the property tax benefits provided to inheritors of commercial and residential properties. The measure also adds new transfer provisions for victims of disasters and individuals severely handicapped.

On November 3 voters approved Proposition 19 (Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act), which makes sweeping changes to a property owner’s ability to transfer their Proposition 13 Assessed Value. The measure generally expands a qualifying homeowners ability to transfers their assessed value and narrows the property tax benefits provided to inheritors of commercial and residential properties. The measure also adds new transfer provisions for victims of disasters and individuals severely handicapped.

Proposition 19 also substantially modifies and in some instances eliminates portions the following initiatives:

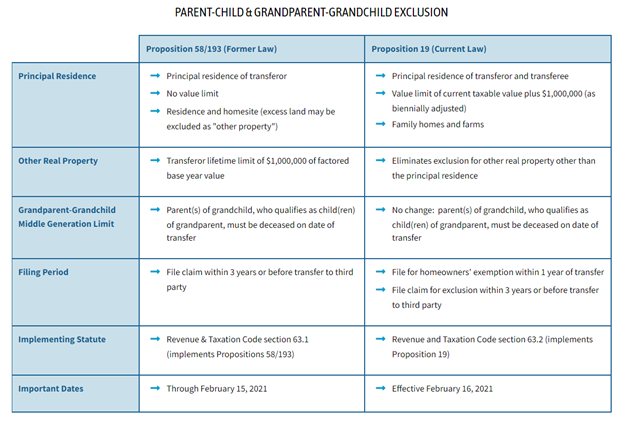

- Propositions 58 and 193: Excludes transfers between parent and child (58) or grandparent and grandchild (193) from reassessment

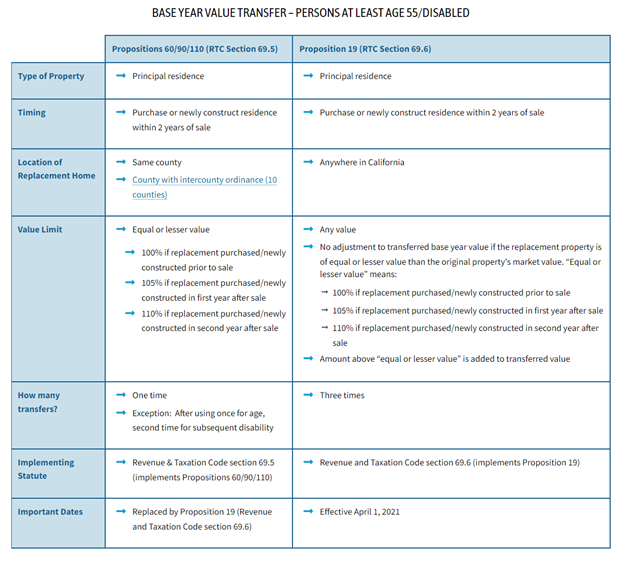

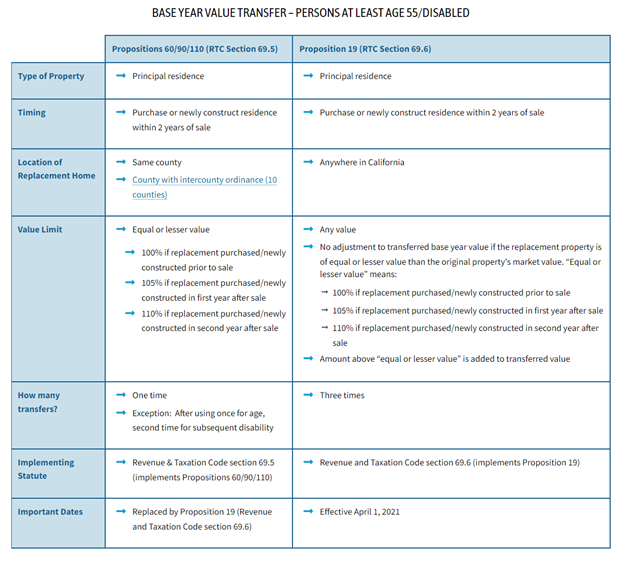

- Propositions 60 and 90: Homeowners 55+ years of age can sell their primary residence and transfer the base year value of that property to a replacement residence if certain conditions are met. Proposition 60 applies to intra-county transfers, while Proposition 90 applies to inter-county transfers under certain conditions

- Proposition 110: Severely disabled persons can transfer the base year value of their primary residence to a replacement residence if certain conditions are met.

Status of Implementation

The measure, which was hastily passed by the legislature in less than a week and put on the November 2020 ballot, changed the state constitution but did not provide implementing statutes. Moreover, portions of the approved language changes are ambiguous, unclear and/or conflicting. As a result, Santa Clara County Assessor Larry Stone was appointed by the California Assessors’ Association (CAA), along with four other Assessors, to an ad-hoc committee of the CAA to help bring clarity to how Proposition 19 will be implemented uniformly by Assessors Statewide. The committee has enlisted subject matter experts and attorneys throughout California and is working closely with the Board of Equalization to provide guidance and where necessary recommend passage, on an urgency basis, of implementing statutes.

This page will be continuously modified as updates are available.

Summary

As described in the voters informational guide “All homeowners who are over 55 (or who meet other qualifications) would be eligible for property tax savings when they move. Only inherited properties used as primary homes or farms would be eligible for property tax savings.” To provide a synopsis of the key provisions below are excerpts of information provided by the state’s independent Legislative Analysis Office.

Disclaimer

This information is intended to provide a general summary of Proposition 19. It is not intended to be a legal interpretation or official guidance, or relied upon for any purpose, but is instead a presentation of summary information. Proposition 19 is a constitutional amendment, so additional legislation, regulations, and statewide guidance are expected to clarify its implementation. If there is a conflict between the information provided here and the proposition or any legal authorities implementing or interpreting the proposition, the text of the proposition and the other implementing or interpretive authorities will prevail. Please continue to visit our website or the website of the State Board of Equalization for more information. We encourage you to consult an attorney for advice on your specific situation. The advice below is subject to change

EXPANDED PORTABILITY FOR TRANSFERRING BASE YEAR VALUE TO NEW HOME

Effective April 1, 2021* Proposition 19 permits eligible homeowners (defined as over 55, severely disabled, or whose homes were destroyed by wildfire or disaster) to transfer their primary residence’s property tax base value to a replacement residence of any value, anywhere in the state.

Under Proposition 19 and pending clarity from the legislature and the Board of Equalization Eligible homeowners can:

- Keep their lower property tax bill when moving to another home anywhere in the state.

- Use the special rules to move to a more expensive home. Their property tax bill would still go up but not by as much as it would be for other homebuyers.

- Use the special rules three times in their lifetime. (for Governor declared disaster victims, there is no limit on the number of times the benefit can be used.)

The provisions of Proposition 60 and Proposition 90 sunset on March 31* and to receive the benefits of these propositions the homeowner must have sold and purchased the new home by March 31. Please note that in Santa Clara County March 31 is a holiday and the Recorder’s office is closed.

To receive the expanded portability benefits of Proposition 19, homeowners must complete at least one of the transactions on or after April 1. Property owners have two years from the transfer of the first property to complete the second transaction.

Proposition 19 also supplements existing transfer provisions exclusively for victims of wildfire or disaster and owners who are “severely disabled.” Upon implementation taxpayers will have to determine and apply for those provisions which are most advantageous for their circumstances

Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located. A non-refundable processing fee of $110 is required in Santa Clara County. Checks should be made out to County of Santa Clara. Credit card payments for the processing fee are accepted in person at our office. We accept VISA, Mastercard, Discover, and American Express.

FAQ: Base Year Transfer

Q: I sold my home (or bought my new home) before April 1, 2021, if I buy my new home/completed new construction (or sold my old home) on or after April 1, can I transfer my prior homes low assessed value to the new home?

Yes, as long as you are on or over the age of 55 (or otherwise qualifying) and the second transactions occurs within two years from the date of the first transfer.

Q: I sold my prior home, which had an assessed value of $300,000 in June 2019 for $2 Million and plan to buy my new home in May 2021 for $2,200,000; Prior to Proposition 19 the law allowed carrying the low assessed value as long as the purchase price was within 110%, does the same apply in Proposition 19?

A: No. The prior law, Proposition 60 and 90, ended on March 31. In the above example the Assessed value would increase from $300,000 to $500,000, the difference between the two purchase prices.

On February 1, 2021 the BOE published answers to many commonly asked questions. The FAQ are available at https://www.boe.ca.gov/prop19/#FAQs and are being updated regularly

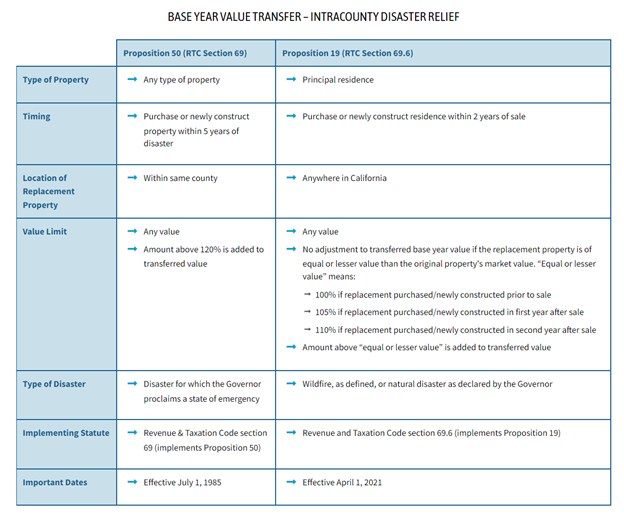

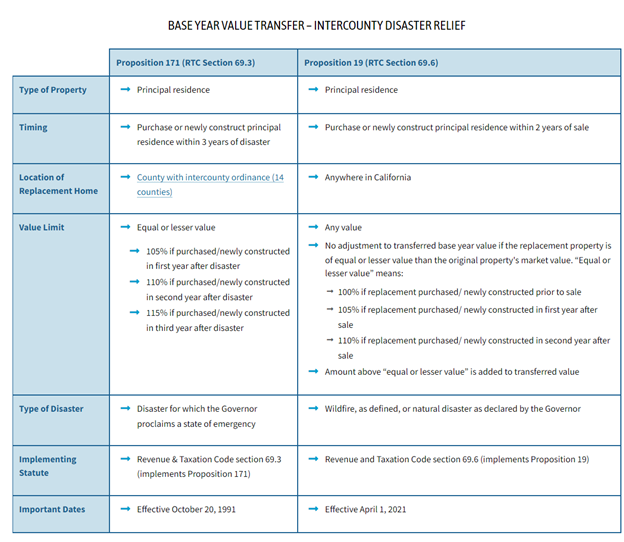

Board of Equalization: Proposition 19 compared to old law (as of 1/17/21)

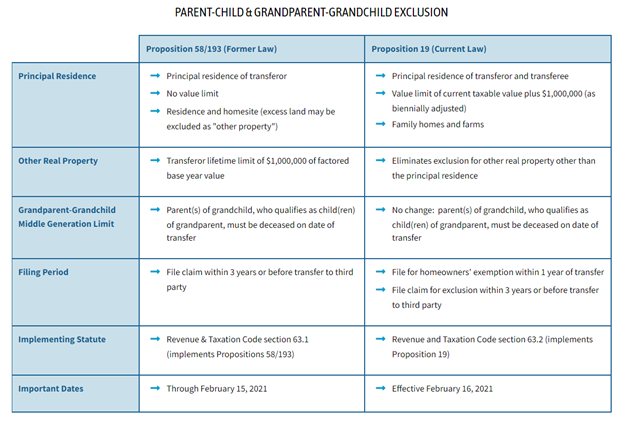

NARROWED SPECIAL RULES FOR INHERITED PROPERTIES.

Starting February 16, 2021*, Proposition 19 narrows substantially the property tax benefits for inherited properties. Specifically, the measure:

Narrows the Assessed Value that can be transferred to two kinds of inherited property: Property used continuously by the child or grandchild as a primary home or property held as a family farm.

The Assessed Value for an inherited home or farm would go up if the price of the property could be sold for exceeds the property’s assessed value by more than $1 million (adjusted for inflation every two years). Two examples best illustrate:

- For example, if the Assessed Value (AV) were $250,000 and the market value when transferred was $1 million, the children would retain the $250,000 assessed value.

- Alternatively, If the market value exceeds this limit ($1M plus the prior Assessed Value), partial relief is available. For example, a family home that has an assessed value of $300,000 with a market value of $2,500,000 when transferred will result in a new assessed value to the children of $1,500,000. The Proposition 19 benefit methodology is as follows: $300,000 AV + $1,000,000 (Proposition 19 benefit) = $1,300,000. The difference between the market value of $2,500,000 compared to $1,300,000 is $1,200,000. This amount is added to the $300,000 AV. Thus, the adjusted base year value is $1,500,000.

Effective February 15, 2021* Proposition 58 and 193 are retired from the State Constitution. These provisions provided generous property tax benefits to inheritors of homes and commercial properties. Properties transferred after February 15 will be subject to Proposition 19’s limited benefits. The Assessor will accept documents notarized or recorded as long as one of them is on or before February 16.

FAQ: Parent Child Transfer

Q: Prop 19 makes the previous parent-child exclusion operative for purchases or transfers that occur on or before February 15, 2021. Since February 15, 2021 is a state holiday, are purchases or transfers that occur on February 16, 2021 eligible for the previous parent-child exclusion?

A: Yes, except for transfers of property by inheritance. The Assessor will accept documents notarized or recorded as long as one of them is on or before February 16.

Q: Prop 19 requires that a family home continue as the family home of the transferee. Must the family home continue as the family home of all transferees?

A: No, only one transferee needs to maintain the family home as his or her principal residence.

Q: Prop 19 requires that a family home continue as the family home of the transferee. By what date must a transferee establish the family home as her family home?

A: The transferee must establish the family home as her family home within one year of the purchase or transfer of the family home.

Q: How do I calculate property tax impact of transferring principal residence to a child or grandchild??

A: The formula in Proposition 19 is complex. To help taxpayers better understand the ramification of parent child transfers under Proposition 19 the Assessor’s Office has created an online estimator. This tool approximates the supplemental assessment(s) and the subsequent regular roll assessment due to a hypothetical transfer of ownership of principal residence from parent to child or grandparent to grandchild. To use this tool go to Prop 19 Assessment Estimator.

Q: Prop 19 makes the parent-child exclusion applicable to family farms. Must a family farm also be the principal residence of the transferee?

A: No, the family farm does not need to be the principal residence of the transferee to qualify for the parent-child exclusion.

On February 1, 2021 the BOE published answers to many commonly asked questions. The FAQ are available at https://www.boe.ca.gov/prop19/#FAQs and are being updated regularly

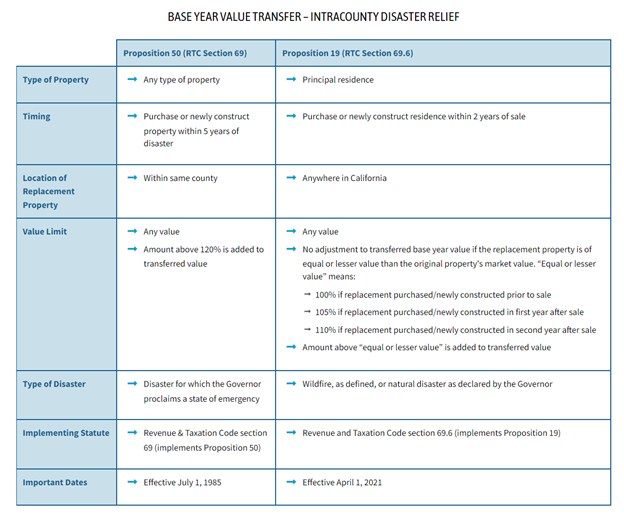

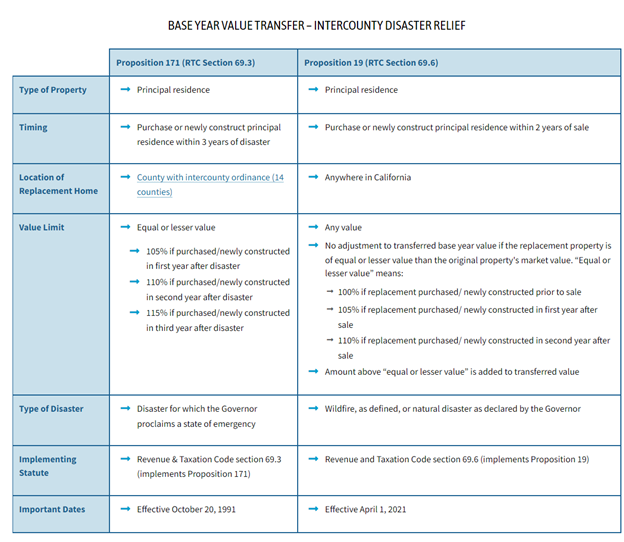

DISASTER RELIEF PORTIONS OF PROPOSITION 19

Board of Equalization: Proposition 19 compared to old law (as of 1/17/21)

*IMPORTANT: Due to County holidays, the Santa Clara County Recorder’s Office and Assessor’s Office are closed Monday, February 15, 2021 and Wednesday, March 31; therefore ownership documents should be recorded as soon as possible.

Resources

CA Board of (BOE)

BOE - Prop 19 (2020) information

LTA 2020-061 Proposition 19

Links

Prop 19 Parent Child On-Line Calculator

Proposition 19 Parent-Child Workshop

Proposition 58/193

Proposition 58 media release

Proposition 60/90

Useful Attachments

Board of Equalization Legal Analysis

California Assessors’ Association Memo to Board of Equalization 12-14-20

Ballot Language

Ballot title, Summary and Analysis

Related Attachments

2022 February Poposition 19 webpage update

On November 3, 2020, voters approved Proposition 19 (Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act), which makes sweeping changes to a property owner’s ability to transfer their Proposition 13 Assessed Value. The measure generally expands a qualifying homeowners ability to transfers their assessed value and narrows the property tax benefits provided to inheritors of commercial and residential properties. The measure also adds new transfer provisions for victims of disasters and individuals severely handicapped.

On November 3, 2020, voters approved Proposition 19 (Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act), which makes sweeping changes to a property owner’s ability to transfer their Proposition 13 Assessed Value. The measure generally expands a qualifying homeowners ability to transfers their assessed value and narrows the property tax benefits provided to inheritors of commercial and residential properties. The measure also adds new transfer provisions for victims of disasters and individuals severely handicapped.

Proposition 19 also substantially modifies and in some instances eliminates portions the following initiatives:

- Propositions 58 and 193: Excludes transfers between parent and child (58) or grandparent and grandchild (193) from reassessment

- Propositions 60 and 90: Homeowners 55+ years of age can sell their primary residence and transfer the base year value of that property to a replacement residence if certain conditions are met. Proposition 60 applies to intra-county transfers, while Proposition 90 applies to inter-county transfers under certain conditions

- Proposition 110: Severely disabled persons can transfer the base year value of their primary residence to a replacement residence if certain conditions are met.

Status of Implementation

The measure, which was hastily passed by the legislature in less than a week and put on the November 2020 ballot, changed the state constitution but did not provide implementing statutes. Moreover, portions of the approved language changes are ambiguous, unclear and/or conflicting. As a result, Santa Clara County Assessor Larry Stone was appointed by the California Assessors’ Association (CAA), along with four other Assessors, to an ad-hoc committee of the CAA to help bring clarity to how Proposition 19 will be implemented uniformly by Assessors Statewide. The committee has enlisted subject matter experts and attorneys throughout California and is working closely with the Board of Equalization to provide guidance and where necessary recommend passage, on an urgency basis, of implementing statutes.

This page will be continuously modified as updates are available.

Summary

As described in the voters informational guide “All homeowners who are over 55 (or who meet other qualifications) would be eligible for property tax savings when they move. Only inherited properties used as primary homes or farms would be eligible for property tax savings.” To provide a synopsis of the key provisions below are excerpts of information provided by the state’s independent Legislative Analysis Office.

Disclaimer

This information is intended to provide a general summary of Proposition 19. It is not intended to be a legal interpretation or official guidance, or relied upon for any purpose, but is instead a presentation of summary information. Proposition 19 is a constitutional amendment, so additional legislation, regulations, and statewide guidance are expected to clarify its implementation. If there is a conflict between the information provided here and the proposition or any legal authorities implementing or interpreting the proposition, the text of the proposition and the other implementing or interpretive authorities will prevail. Please continue to visit our website or the website of the State Board of Equalization for more information. We encourage you to consult an attorney for advice on your specific situation. The advice below is subject to change

EXPANDED PORTABILITY FOR TRANSFERRING BASE YEAR VALUE TO NEW HOME

Effective April 1, 2021* Proposition 19 permits eligible homeowners (defined as over 55, severely disabled, or whose homes were destroyed by wildfire or disaster) to transfer their primary residence’s property tax base value to a replacement residence of any value, anywhere in the state.

Under Proposition 19 and pending clarity from the legislature and the Board of Equalization Eligible homeowners can:

- Keep their lower property tax bill when moving to another home anywhere in the state.

- Use the special rules to move to a more expensive home. Their property tax bill would still go up but not by as much as it would be for other homebuyers.

- Use the special rules three times in their lifetime. (for Governor declared disaster victims, there is no limit on the number of times the benefit can be used.)

The provisions of Proposition 60 and Proposition 90 sunset on March 31, 2021, and to receive the benefits of these propositions the homeowner must have sold and purchased the new home by March 31, 2021.

To receive the expanded portability benefits of Proposition 19, homeowners must complete at least one of the transactions on or after April 1, 2021. Property owners have two years from the transfer of the first property to complete the second transaction.

Proposition 19 also supplements existing transfer provisions exclusively for victims of wildfire or disaster and owners who are “severely disabled.” Upon implementation taxpayers will have to determine and apply for those provisions which are most advantageous for their circumstances

Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located. A non-refundable processing fee of $110 is required in Santa Clara County. Checks should be made out to County of Santa Clara. Credit card payments for the processing fee are accepted in person at our office. We accept VISA, Mastercard, Discover, and American Express.

FAQ: Base Year Transfer

Q: I sold my home (or bought my new home) before April 1, 2021, if I buy my new home/completed new construction (or sold my old home) on or after April 1, 2021, can I transfer my prior homes low assessed value to the new home?

A: Yes, as long as you are on or over the age of 55 (or otherwise qualifying) and the second transactions occurs within two years from the date of the first transfer.

Q: I sold my prior home, which had an assessed value of $300,000 in June 2019 for $2 Million and plan to buy my new home in May 2021 for $2,200,000; Prior to Proposition 19 the law allowed carrying the low assessed value as long as the purchase price was within 110%, does the same apply in Proposition 19?

A: Yes, in the above example the Assessed value would remain $300,000 factored by the CCPI for 2 years.

On February 1, 2021 the BOE published answers to many commonly asked questions. The FAQ are available at https://www.boe.ca.gov/prop19/#FAQs and are being updated regularly

Board of Equalization: Proposition 19 compared to old law (as of 1/17/21)

NARROWED SPECIAL RULES FOR INHERITED PROPERTIES.

Starting February 16, 2021, Proposition 19 narrows substantially the property tax benefits for inherited properties. Specifically, the measure:

Narrows the Assessed Value that can be transferred to two kinds of inherited property: Property used continuously by the child or grandchild as a primary home or property held as a family farm.

The Assessed Value for an inherited home or farm would go up if the price of the property could be sold for exceeds the property’s assessed value by more than $1 million (adjusted for inflation every two years). Example below (BOE LTA 2021/054):

- Example 3: Excess Amount Calculation. On March 1, 2021, Parents' principal residence has a factored base year value of $250,000. The Excluded Amount is $1,250,000 ($1,000,000 plus $250,000 Property Tax Rule 462.520 factored base year value). Parents transfer 100 percent interest in their principal residence to Child on March 1, 2021.

- Examples 3-1 and 3-2 demonstrate alternatives using the facts described in Example 3.

- Example 3-1: Zero Excess Amount. The principal residence has a full cash value of $900,000 on the date of transfer. Since $900,000 is less than the $1,250,000 Excluded Amount, the Excess Amount is zero. Therefore, the New Taxable Value on the date of transfer is the factored base year value of $250,000.

- Example 3-2: Excess Amount. The principal residence has a full cash value of $1,300,000 on the date of transfer. Since $1,300,000 is greater than the $1,250,000 Excluded Amount, there is an Excess Amount of $50,000. Therefore, the New Taxable Value of the principal residence on the date of transfer is $300,000 ($250,000 factored base year value plus $50,000 Excess Amount).

Proposition 19 repealed the former parent-child and grandparent-grandchild exclusions that were added by Propositions 58 (1986) and 193 (1996). These exclusions are now inoperative as of February 16, 2021, and are only effective for parent-child or grandparent-grandchild transfers that occurred on or before February 15, 2021.

FAQ: Parent Child Transfer

Q: Prop 19 makes the previous parent-child exclusion operative for purchases or transfers that occur on or before February 15, 2021. Since February 15, 2021 is a state holiday, are purchases or transfers that occur on February 16, 2021 eligible for the previous parent-child exclusion?

A: Yes, except for transfers of property by inheritance. The Assessor will accept documents notarized or recorded as long as one of them is on or before February 16, 2021.

Q: Prop 19 requires that a family home continue as the family home of the transferee. Must the family home continue as the family home of all transferees?

A: No, only one transferee needs to maintain the family home as his or her principal residence.

Q: Prop 19 requires that a family home continue as the family home of the transferee. By what date must a transferee establish the family home as her family home?

A: The transferee must establish the family home as her family home within one year of the purchase or transfer of the family home.

Q: How do I calculate property tax impact of transferring principal residence to a child or grandchild??

A: The formula in Proposition 19 is complex. To help taxpayers better understand the ramification of parent child transfers under Proposition 19 the Assessor’s Office has created an online estimator. This tool approximates the supplemental assessment(s) and the subsequent regular roll assessment due to a hypothetical transfer of ownership of principal residence from parent to child or grandparent to grandchild. To use this tool, go enter the requested Base Year Value (BYV) and Fair Market Value (FMV) information in theProp 19 Assessment Estimator.

Q: Prop 19 makes the parent-child exclusion applicable to family farms. Must a family farm also be the principal residence of the transferee?

A: No, the family farm does not need to be the principal residence of the transferee to qualify for the parent-child exclusion.

The BOE published answers to many commonly asked questions. The FAQ are available at https://www.boe.ca.gov/prop19/#FAQs and are being updated regularly

DISASTER RELIEF PORTIONS OF PROPOSITION 19

Board of Equalization: Proposition 19 compared to old law (as of 1/17/21)

Resources

CA Board of (BOE)

BOE - Prop 19 (2020) information

LTA 2020-061 Proposition 19

Links

Prop 19 Parent Child On-Line Calculator

Proposition 19 Parent-Child Workshop

Proposition 58/193

Proposition 58 media release

Proposition 60/90

Useful Attachments

Board of Equalization Legal Analysis

California Assessors’ Association Memo to Board of Equalization 12-14-20

Ballot Language

Ballot title, Summary and Analysis

Related Attachments

REVIEW DUE TO VALUE DECLINE

State law allows the Assessor to temporarily reduce the assessed value of mobile home in certain cases where the fair market value is lower than the assessed value. If this may be the situation for a mobile home you own, request forms are available to view and/or print by clicking below. They are also available by calling or writing the Assessor's Office.

THE DEADLINE TO FILE THIS FORM FOR THE 2025-2026 ASSESSMENT ROLL ENDS AUGUST 1. To apply for a reduction for the 2025-2026 Assessment Roll please visit the Assessor's website after you receive your notification card in June 2025.

Attachements:

About Prop 8

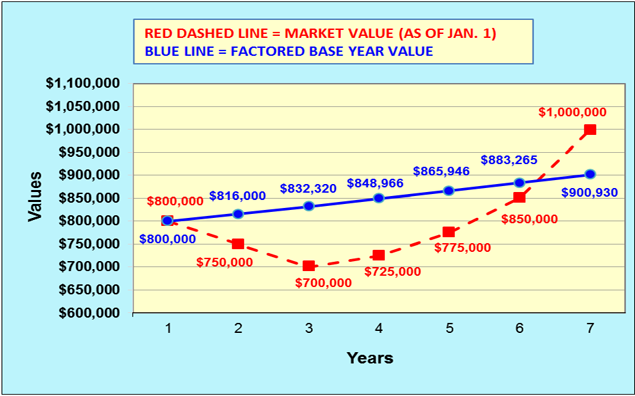

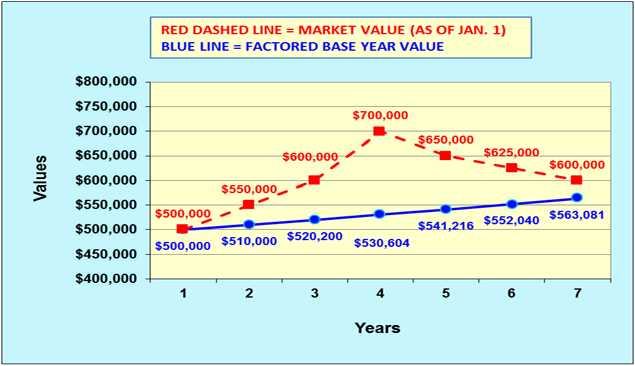

Proposition 8 was passed in November 1978 as an amendment to Proposition 13 and implemented as Revenue & Taxation Code Section 51(a)(2). It annually caps the assessed value of property as of the lien date (January 1) at the lesser of its market value or its factored base year value.

HOW IT WORKS

Proposition 8 allows a temporary reduction when the market value of property has fallen below its factored base year value as of the January 1 lien date. Once a Prop 8 reduction has been enrolled, the property’s assessment must be reviewed annually to ensure that the lesser of the market value or the factored base year value is enrolled.

The property’s base year value continues to be factored at a maximum two percent per year, setting its maximum assessed value. As the market recovers the market value of a property will increase based on market conditions which are not restricted to a two percent growth. The value enrolled will follow the market growth rate until the market value exceeds the factored base year value and the lower factored base year is enrolled.

Factored base year value: the value established as of the date of acquisition and/or completion of new construction. This value is adjusted each year by an inflation factor. The inflation factor is the lesser of 2% or the California Consumer Price Index (CCPI) rate.

For more information about factored base year value, see Understanding Proposition 13.

Related Links:

- Decline In Value Request

- Proposition 8 Request for Review Form (printable)

- Mobilehome Proposition 8 Request for Review Form

- How to File a formal appeal of your assessed value, a how to video

- Why Pay When It's Free!

Attachments