Earlier today, the Santa Clara County Assessor’s Office released market trend property value data that is being used by the Assessor to determine the assessed value of all residential property, including the status of the remaining 36,000 residential and 2,000 commercial properties in which the assessment was reduced during the prior year due to the decline in property values during the Great Recession. “This market data confirms the continued strength of Silicon Valley’s economy. For the first time in years, every city in Santa Clara County experienced a year-over-year increase in market values,” said County Assessor Larry Stone. Despite the economic recovery, 23,000 properties remain assessed below their base year purchase price. The assessed values of the remaining 13,500 properties, that did not change ownership, were increased to reflect the recovering market—up to their Proposition 13-protected base year value.

“Overall, this is very good news for these 36,000 homeowners who weathered the biggest downturn since the Great Depression. For most people, their home is their largest asset, so for every dollar increase in property taxes, there is a $100 increase in homeowner equity,” said Stone. “After several years of losing equity, property owners are finally gaining a long-awaited appreciation in the value of their property.”

For 13,500 properties, the value lost during the Great Recession was fully restored this year, and the market value now exceeds the original purchase price. While the assessed value of the remaining 23,000 properties increased, allowing for the restoration of some lost equity, they are still assessed below their Proposition 13-assessed value. “Unfortunately, the depth of the recession was so severe that even the ‘red-hot’ residential market we are experiencing hasn’t been great enough to restore all value lost during the downturn,” said Stone.

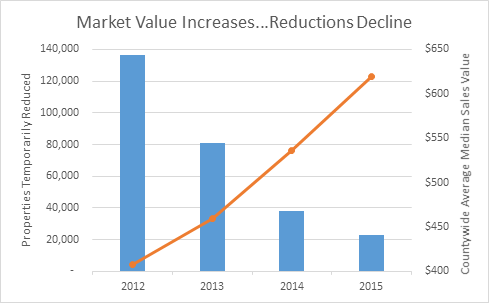

This is the third consecutive year that the number of properties assessed below their purchase price has declined. As reflected in the table below these reductions correspond directly to increases in market value.

When the market value of a property declines below the previously established assessed value measured as of January 1 each year (lien date), the Assessor is required to proactively reduce the assessed value to reflect the lower market value. However, as the real estate market rebounds, the Assessor is required to “restore” the assessed value for properties previously reduced during the downturn.

Related Documents: