Tested by the worst pandemic in 100 years which shuttered many businesses, including the iconic Fairmont Hotel, Silicon Valley’s economy has rebounded, exceeding expectations. The strength of the regions underlying fundamentals were reflected in the annual assessment roll released by Santa Clara County Assessor Larry Stone earlier today.

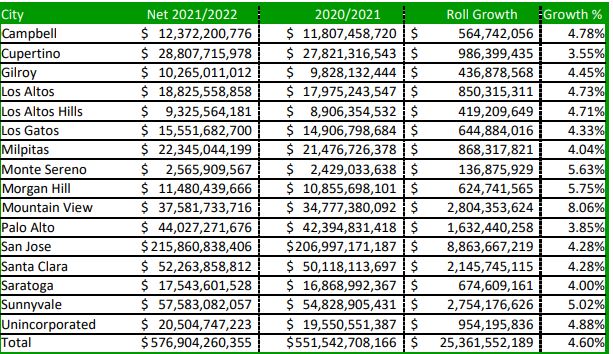

The assessment roll, which reports the total net assessed value of all real and business property in Santa Clara County as of January 1, 2021, reached $576.9 billion, a 4.6 percent increase over the prior year.

“This time last year the nation appeared to be on the precipice of the worst economic crisis since the Great Depression, triggered by the Covid-19 pandemic,” said Stone. “Medical and business regulations designed to bridge the fiscal gap until vaccines were available, prevented a major collapse of the U.S. economy. Santa Clara County companies, including Google, Apple, Intel, Zoom, Microsoft and Adobe, benefitted as the nation turned almost overnight, to a remote working economy.” The “Great Recession”, starting in 2008, lasted nearly eight years. The Covid recession may last as little as 18 months.

The growth in property assessed values is attributed to multiple factors.The leading contributors are changes in ownership and new construction, which accounted for 61% and 29% of the total increase in assessed values. Not surprisingly, the pace of new construction was delayed somewhat, due to the uncertainty over the economic and business outlook during Covid. notable exception was construction on Google’s new Bayview campus which accounted for $720 million of the County’s total $6.69 billion in new construction. This provided Mountain View with a significant boost in roll growth to 8.06% compared to the County total of 4.66%. verall, the Silicon Valley office market has emerged relatively strong. Major acquisitions of office and commercial buildings contributed to the overall growth in property assessments compared to the prior year.

The assessment of business property, i.e. machinery, equipment, computers, and fixtures declined by 1%, to $40.4 billion. The final component of the 2021 assessment roll growth is the increase in the assessed value of properties with no activity or transactions. Proposition 13 mandates that the assessment of those properties is limited to the California Consumer Price Index (CCPI) or 2 percent, whichever is lower. A struggling economy throughout 2020 limited the CCPI to just 1%.

“Homeowners are major beneficiaries of the hot residential market, taking advantage of the stunning appreciation in market value of their homes, while their assessment increased only one percent,” said Stone.

Consequently, the difference between the assessed value and the market value of most residential properties in Santa Clara County provides an unanticipated financial benefit to all homeowners, often at the expense of funding for schools and local governments.

Silicon Valley was not entirely immune to the pandemic recession. Many sectors such as hospitality, non-grocery brick and mortar retail, restaurants and entertainment, all suffered financially.

“The Assessor’s Office has launched multiple programs to help property owners and businesses seriously impacted by Covid,” said Stone. The Assessor’s Office has requested information and data from businesses to determine the financial impact of declines in market value of commercial properties, and are using that information to make proactive assessment reductions where warranted. “As Assessor, my job is to get it right. I am not a revenue agent for local government. When the market value of a property declines below the original purchase price, we lower the assessment,” said Stone.

“The Covid crisis required a course correction. Initially, we feared the recession would extend for a long period of time. Thankfully, the impact has been more gradual in large part by an extraordinarily strong residential market,” said Stone. Home prices in Santa Clara County have increased 19% year over year to nearly $1.4 million. An increase in demand for suburban properties is driven by an increase in remote working. Millennials are leaving urban apartments for ownership in the suburbs. In Silicon Valley, luxury home sales jumped 46%, and prices of condominiums are up 36%.

Accelerated vaccine distribution, trillions of dollars of federal and state stimulus, pent-up demand in both the residential and corporate sectors, and low interest rates equates to a “Roaring 20’s” U.S. economy in 2021-22,” said Stone.

The major beneficiaries of property tax revenue are public schools, community colleges, cities, and Santa Clara County. Fifty percent of local property tax revenue generated in Santa Clara County goes to fund public education.

Requesting a Temporary Reduction in Assessed Value

“As Assessor, my responsibility is to ensure that accurate values are enrolled based upon market conditions. When market value (as of January 1, 2021) falls below the existing assessment, my office is required by law to temporarily reduce the assessed value to reflect the declining market value,” said Stone. “This year the majority of the value reductions were due to the impact of Covid on commercial properties reflecting a reduction of 222 million.

Property owners who demonstrate their assessment is higher than the market value of their property are encouraged to request an informal review of their assessment. “My appraisal staff will complete as many informal reviews as possible prior to August 1, the deadline for making changes that will be reflected on the property tax bill mailed in the fall,” said Stone. To apply for a reduction go to www.sccassessor.org/prop8.

The Assessor’s Office has a brief two-minute video that answers the question, “why assessed values for most properties have not declined this Covid year”. The video can be accessed at https://youtu.be/kFC2X0cG-qY.

Annual Notification of Assessed Value

On June 30, the Assessor’s Office mailed annual assessment notices to 495,315 property owners, reporting each property’s 2021 assessed value. The notice serves as the basis for the property tax bill. Santa Clara County is one of only nine counties in California which provides early notice to all property owners. “Most property owners in California learn of their assessed value for the first time when they receive their property tax bill in October,” said Stone.

Property owners can also access an on-line tool provided by the County Finance Agency to learn exactly how much of their property taxes go to neighborhood public schools, community colleges and government agencies, including the 15 cities and county government.

Property owners who disagree with the assessed value printed on the notice, are encouraged to take advantage of the Assessor’s “online tool,” available 24/7, enabling property owners to review the sale of comparable properties used to determine their assessment. This interactive service modeled after online banking, the Opt-In Tool, allows taxpayers to securely receive assessment notices, in addition to interacting with the Assessor’s Office electronically rather than by mail, telephone, or in person. To access the data, a property owner must have a username and password created last year, or the PIN listed on the annual assessment notice. To login go to: https://www.sccassessor.org/index.php/online-services/email-opt-in/email-opt-in-login

The annual notice also describes the process for filing a formal assessment appeal by the September 15, 2021 deadline. Residential property owners who decide to file a formal appeal, are encouraged to request their appeal be adjudicated by an independent residential Value Hearing Officer (VHO), rather than the more formal three-member Assessment Appeals Board. VHO hearings are scheduled frequently, allowing a more rapid resolution.

“Property owners who disagree with the assessed value should not wait for the tax bill before filing an appeal, as the tax bill is mailed by the Tax Collector after the assessment appeal filing deadline,” said Stone. More information is available from the Clerk of the Board by calling (408) 299-5088, or going to their website:http://www.sccgov.org/assessmentappeals

More information about the Assessor’s Office is available at www.sccassessor.org.

Santa Clara County Net Assessed Value and Roll Growth 2021-2022