Every year we work to continuously improve the report and if you have suggestions please do not hesitate to let our office know.

Every year we work to continuously improve the report and if you have suggestions please do not hesitate to let our office know.

Every year we work to continuously improve the report and if you have suggestions please do not hesitate to let our office know.

Tested by the worst pandemic in 100 years which shuttered many businesses, including the iconic Fairmont Hotel, Silicon Valley’s economy has rebounded, exceeding expectations. The strength of the regions underlying fundamentals were reflected in the annual assessment roll released by Santa Clara County Assessor Larry Stone earlier today.

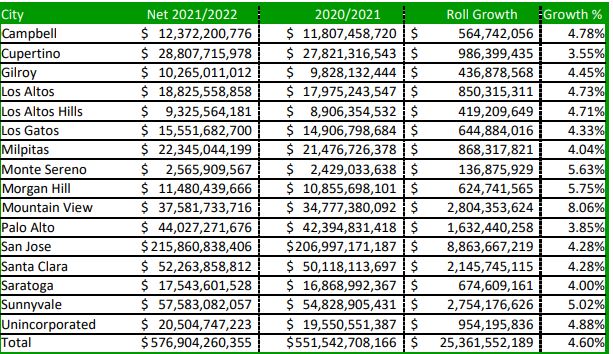

The assessment roll, which reports the total net assessed value of all real and business property in Santa Clara County as of January 1, 2021, reached $576.9 billion, a 4.6 percent increase over the prior year.

“This time last year the nation appeared to be on the precipice of the worst economic crisis since the Great Depression, triggered by the Covid-19 pandemic,” said Stone. “Medical and business regulations designed to bridge the fiscal gap until vaccines were available, prevented a major collapse of the U.S. economy. Santa Clara County companies, including Google, Apple, Intel, Zoom, Microsoft and Adobe, benefitted as the nation turned almost overnight, to a remote working economy.” The “Great Recession”, starting in 2008, lasted nearly eight years. The Covid recession may last as little as 18 months.

The growth in property assessed values is attributed to multiple factors.The leading contributors are changes in ownership and new construction, which accounted for 61% and 29% of the total increase in assessed values. Not surprisingly, the pace of new construction was delayed somewhat, due to the uncertainty over the economic and business outlook during Covid. notable exception was construction on Google’s new Bayview campus which accounted for $720 million of the County’s total $6.69 billion in new construction. This provided Mountain View with a significant boost in roll growth to 8.06% compared to the County total of 4.66%. verall, the Silicon Valley office market has emerged relatively strong. Major acquisitions of office and commercial buildings contributed to the overall growth in property assessments compared to the prior year.

The assessment of business property, i.e. machinery, equipment, computers, and fixtures declined by 1%, to $40.4 billion. The final component of the 2021 assessment roll growth is the increase in the assessed value of properties with no activity or transactions. Proposition 13 mandates that the assessment of those properties is limited to the California Consumer Price Index (CCPI) or 2 percent, whichever is lower. A struggling economy throughout 2020 limited the CCPI to just 1%.

“Homeowners are major beneficiaries of the hot residential market, taking advantage of the stunning appreciation in market value of their homes, while their assessment increased only one percent,” said Stone.

Consequently, the difference between the assessed value and the market value of most residential properties in Santa Clara County provides an unanticipated financial benefit to all homeowners, often at the expense of funding for schools and local governments.

Silicon Valley was not entirely immune to the pandemic recession. Many sectors such as hospitality, non-grocery brick and mortar retail, restaurants and entertainment, all suffered financially.

“The Assessor’s Office has launched multiple programs to help property owners and businesses seriously impacted by Covid,” said Stone. The Assessor’s Office has requested information and data from businesses to determine the financial impact of declines in market value of commercial properties, and are using that information to make proactive assessment reductions where warranted. “As Assessor, my job is to get it right. I am not a revenue agent for local government. When the market value of a property declines below the original purchase price, we lower the assessment,” said Stone.

“The Covid crisis required a course correction. Initially, we feared the recession would extend for a long period of time. Thankfully, the impact has been more gradual in large part by an extraordinarily strong residential market,” said Stone. Home prices in Santa Clara County have increased 19% year over year to nearly $1.4 million. An increase in demand for suburban properties is driven by an increase in remote working. Millennials are leaving urban apartments for ownership in the suburbs. In Silicon Valley, luxury home sales jumped 46%, and prices of condominiums are up 36%.

Accelerated vaccine distribution, trillions of dollars of federal and state stimulus, pent-up demand in both the residential and corporate sectors, and low interest rates equates to a “Roaring 20’s” U.S. economy in 2021-22,” said Stone.

The major beneficiaries of property tax revenue are public schools, community colleges, cities, and Santa Clara County. Fifty percent of local property tax revenue generated in Santa Clara County goes to fund public education.

Requesting a Temporary Reduction in Assessed Value

“As Assessor, my responsibility is to ensure that accurate values are enrolled based upon market conditions. When market value (as of January 1, 2021) falls below the existing assessment, my office is required by law to temporarily reduce the assessed value to reflect the declining market value,” said Stone. “This year the majority of the value reductions were due to the impact of Covid on commercial properties reflecting a reduction of 222 million.

Property owners who demonstrate their assessment is higher than the market value of their property are encouraged to request an informal review of their assessment. “My appraisal staff will complete as many informal reviews as possible prior to August 1, the deadline for making changes that will be reflected on the property tax bill mailed in the fall,” said Stone. To apply for a reduction go to www.sccassessor.org/prop8.

The Assessor’s Office has a brief two-minute video that answers the question, “why assessed values for most properties have not declined this Covid year”. The video can be accessed at https://youtu.be/kFC2X0cG-qY.

Annual Notification of Assessed Value

On June 30, the Assessor’s Office mailed annual assessment notices to 495,315 property owners, reporting each property’s 2021 assessed value. The notice serves as the basis for the property tax bill. Santa Clara County is one of only nine counties in California which provides early notice to all property owners. “Most property owners in California learn of their assessed value for the first time when they receive their property tax bill in October,” said Stone.

Property owners can also access an on-line tool provided by the County Finance Agency to learn exactly how much of their property taxes go to neighborhood public schools, community colleges and government agencies, including the 15 cities and county government.

Property owners who disagree with the assessed value printed on the notice, are encouraged to take advantage of the Assessor’s “online tool,” available 24/7, enabling property owners to review the sale of comparable properties used to determine their assessment. This interactive service modeled after online banking, the Opt-In Tool, allows taxpayers to securely receive assessment notices, in addition to interacting with the Assessor’s Office electronically rather than by mail, telephone, or in person. To access the data, a property owner must have a username and password created last year, or the PIN listed on the annual assessment notice. To login go to: https://www.sccassessor.org/index.php/online-services/email-opt-in/email-opt-in-login

The annual notice also describes the process for filing a formal assessment appeal by the September 15, 2021 deadline. Residential property owners who decide to file a formal appeal, are encouraged to request their appeal be adjudicated by an independent residential Value Hearing Officer (VHO), rather than the more formal three-member Assessment Appeals Board. VHO hearings are scheduled frequently, allowing a more rapid resolution.

“Property owners who disagree with the assessed value should not wait for the tax bill before filing an appeal, as the tax bill is mailed by the Tax Collector after the assessment appeal filing deadline,” said Stone. More information is available from the Clerk of the Board by calling (408) 299-5088, or going to their website:http://www.sccgov.org/assessmentappeals

More information about the Assessor’s Office is available at www.sccassessor.org.

Santa Clara County Net Assessed Value and Roll Growth 2021-2022

No, Proposition 19 is clear that Proposition 58 applies to transfers that occur on or before February 15, 2021, and that Proposition 19 applies to transfers that occur on or after February 16, 2021.

The date of death is the date of change in ownership. The law in effect as of the date of death will apply. Proposition 19 is clear that Proposition 58 applies to transfers that occur on or before February 15, 2021, and Proposition 19 applies to transfers that occur on or after February 16, 2021.

No. As long as the date of transfer is on or before February 15, 2021, the transfer will qualify for the Proposition 58/193 exclusion. Property Tax Rule 462.260 makes clear that the recordation date of a deed is rebuttably presumed to be the transfer date. This means that if evidence is shown that the transfer occurred prior to the recordation date, the assessor should accept that earlier date. Such evidence could be, for example, the date of a notarized document of transfer, such as a deed.

Yes. For property tax purposes, we look through the trust to determine who has present beneficial ownership. Therefore, if all requirements are otherwise satisfied, transfers to and from a trust are eligible for the exclusion.

Proposition 19 does not change the property tax rules surrounding the operation of trust, including trusts with share and share alike provisions. However, after February 15, 2021, only the family home and family farm may be excluded from change in ownership.

No. As long as the property becomes the family home of one of the two children within one year of the transfer, the property can qualify for the exclusion.

Yes, as long the purchase or completion of new construction of the replacement property occurs after April 1, 2021. Only one of the transactions must occur after April 1, 2021 to qualify under the new rules.

No, at least one of the transactions must be after the April 1, 2021 effective date.

These time limits are dealing with 2 different issues. The replacement residence must be purchased or newly constructed within 2 years (before or after) the sale of the original residence. The Proposition 19 application must be filed within 3 years of the date of the replacement residence is purchased or newly constructed in order to receive full benefits. If the application is filed after 3 years, only prospective relief will be granted.

The bill will be based on their purchase price until the application is approved. Once the application is approved, they will receive a credit/refund from the Tax Collector for any overpayments. Typical turnaround time is 3-4 months. The longest delay are transfers in the beginning of the year because of the close of the Assessment roll or waiting for assessed values from other counties. However, with the new rules, I would think the volume will increase, so turnaround time might be a little longer.

Yes. The claimant needs to be on title in some percentage on both the original and replacement residences and can have others on title as well.

Yes, they will receive 100% of the benefit. It doesn’t matter what percentage you own, You only have to be on title of the property that is sold and the property that is purchased.

As long as the homeowner can prove that the sold property was owned and occupied as the principal place of residence, he or she can meet the residency requirement. Proof of residency may include vehicle registration, bank accounts, or income tax records. Utility bills do not qualify because they might be sent to a renter.

However, the claimant must be eligible for the homeowner exemption and have lived there long enough to be able to provide the documentation as mentioned above. A principal residence is a person’s true, fixed, and permanent home and principal establishment to which the owner, whenever absent, intends to return.

Yes, if the replacement property is the primary residence at time you apply for Proposition 19.

Yes, if the original property is sold within 2 years of purchasing your replacement property and the original property was eligible for the homeowner exemption, either at the time of sale or within two years of the purchase or new construction of replacement dwelling.

Sometimes a realtor might assist you, but it is not an automatic grant. You must fill out an application and file it with the Assessor’s office where the replacement property is purchased. A copy of a driver’s license or birth certificate should be attached to the application. If you are not sure if you have filed an application, call the Assessor’s office to check.

Yes, up to three additional times. Under Proposition 19, all Prop 60/90 base year transfer are not taken into account.

Yes, assuming all the other qualifications are met and the two transactions of selling the original residence and buying the new residence are within 2 years of each other.

Yes, as long as you have moved into the inherited residence and live in it as your primary place of residence. If you are over age 55, you may sell your primary residence, buy another residence, and transfer the base year value, if all the other requirements (timing, value, residency, timely filed claim) are met. It does not matter how you acquired your original property.

Assuming you meet all the qualifications for a Proposition 19 base year value transfer, the base year value is transferred as of the latest qualifying date:

- The date the original property sold, or

- The date the replacement property is purchased, or

- The date the new construction of the replacement property is completed.

In your case, the base year value would be transferred as of November 2021 because that is the latest qualifying date. You are responsible for the increased taxes from the time the replacement property was purchased until the original property was sold.

Yes, if the date of the completion of the new construction is within 2 years of the sale of the original house. The Assessor’s office will do a market appraisal as of the date of completion on the new construction including the land of what the new house would sell for. The market value of both the land and improvements is what the appraiser uses to compare with the sale of the original house.

Like the existing disability requirements, the applicant’s physician must complete a Certificate Disability indicating that their severe disability requires them to move to a new residence that meets the needs of their disability. The Assessor’s office will provide you with the certificate, along with the application for the Proposition 19 or Proposition 110 transfer. The most common request for a transfer for a disability is moving from a two-story home to a single-story home.

Yes. Generally, (with a few exceptions) the total of your base year value is transferred to the manufactured home. Sometimes, it is not advantageous because of the lower cost of the manufactured home.

As in past years, transactions that occur after January 1, will not begin to be processed until after July 1. As we are setting up new processes and procedures, we have no way to know for sure how long it will take to process.

No, you must be at least 55 when your original property sells. While you may be 54 when you purchase your replacement property, you must be at least 55 when you sell your original property.

You do not need to fill out any forms or notify the Assessor’s office of your sale or purchase until you close escrow on both properties. Once both properties have closed escrow you can download an application (BOE-19-B) from the Assessor’s office website in which your replacement property is purchased. Please mail the original application with a copy of your driver’s and any applicable fee’s to your local Assessor’s Office. You do not need to include copies of escrow documents or deeds, we verify everything in house.

The tax base is not split, and only one of you can transfer the entire tax base. If you qualify to transfer the tax base at this time, your former spouse can apply for the benefit in the future using other properties.

Yes, we anticipate charging the same filing fee of $110.

Proposition 3 is a constitutional amendment passed in 1982 that provides property tax relief to an owner (individual or legal entity) whose property has been taken by eminent domain proceedings, acquisition by a public entity, or governmental action resulting in a judgment of inverse condemnation. Section 68 of the Revenue and Taxation Code provides the statutory authority to implement Proposition 3. Rule 462.500 interprets, implements and makes specific Section 68.

When a taxpayer purchases or constructs a replacement property as a result of his/her original property being taken by governmental action, under certain conditions, the adjusted base year value of the original property may be transferred to the replacement property. If a transaction qualifies, Proposition 3 provides an exclusion from what would otherwise be a full market value reassessment of the replacement property.

1. You must be the owner(s) of real property that has been taken by governmental action. 2. You must have been displaced from the original property by governmental action. 3. The original property must be located in California. 4. The request for tax relief must be received in a timely manner. A request for relief is considered timely if made within four years of the following dates:

- For property acquired by eminent domain, the date the final order of condemnation is recorded or the date the taxpayer vacates the property taken, whichever is later.

- For property acquired by a public entity by purchase or exchange, the date of conveyance or the date the taxpayer vacates the property taken, whichever is later.

- For property taken by inverse condemnation, the date the judgment of inverse condemnation becomes final or the date the taxpayer vacates the property taken, whichever is later.

1. The replacement property must be acquired before a request is made to transfer the base year value. 2. The owner(s) of property taken must obtain title to comparable replacement property. The acquisition of an ownership interest in a legal entity which, directly or indirectly, owns real property is not an acquisition of comparable property. 3. The replacement property must be acquired or newly constructed after the earliest of the following dates:

- The date the initial written offer is made for the property taken by the acquiring entity.

- The date the acquiring entity takes final action to approve a project which results in an offer for, or the acquisition of, the property taken.

- The date a Notice of Determination, Notice of Exemption, or other similar notice, is recorded by the public entity acquiring the taxpayer's property and the public project has been approved.

- The date, as declared by the court, that the property was taken.

Property acquired or newly constructed prior to these dates is not eligible for relief. However, new construction on land that is ineligible due the fact that the land was acquired prior to these dates may be eligible for relief if such new construction is completed on or after the earliest of these dates. 4. The replacement and displaced properties must be comparable in size, utility, and function

- A replacement property is considered comparable in size when it will be used in the same way as the displaced property, and its full cash value does not exceed 120 percent of the award or purchase price paid for the original property.

- A replacement property is considered comparable in function and utility if it is, or is intended to be, used in the same manner as the property taken and is subject to similar governmental restrictions, for example, zoning. To be considered similar in function and utility, the property taken and the replacement property both must fall into the same category:

Category A: Single-family residence or duplex

Category B: Commercial, investment, income, or vacant property

Category C Agricultural property

If the property taken is a residence or duplex that is rented, it can be replaced with either another singe-family residence under Category A or with a Category B property. However, before being able to replace the property with a Category B property, sufficient proof must be provided to the county assessor showing that the property taken was used as income property.

My property was under a threat of condemnation by a redevelopment agency that wanted me to sell my property to them so they could sell it to a specific third (private) party. The agency indicated that if we did not reach an agreement, they would recommend to the board of the agency that the agency take formal action to commence acquisition proceedings pursuant to the power of eminent domain. Instead, I sold my property to a private company who purchased it on behalf of that specific (third) party.

No, You won't be able. A sale directly to a private party under threat of condemnation by a governmental entity is not displacement from property by eminent domain proceedings, by acquisition by a public entity, or by governmental action which results in a judgment of inverse condemnation. Additionally, you will not have the required documents from your sale to show your property was sold under these conditions.

No. The only location restriction of the displaced and the replacement properties are that they both must be located in California.

The land you purchased prior to your property being taken would not qualify for the base year value transfer since it was acquired prior to your displacement from the original property; however, since the new construction will be completed after the date of displacement, you may transfer your entire base year value to the new construction as long as the new improvement's full cash value does not exceed 120 percent of the purchase price paid for the property taken. The new construction must be completed, however, within four years of the date of conveyance or the date you vacate the property taken, whichever is later, as discussed in question 3 above.

Yes, the purchase of a partial interest in real property is eligible for property tax relief. However, the purchase of a partial interest in a legal entity that holds real property is not eligible for any relief.

Relief can only be applied to the portion of the property that is of similar function and utility as the taken property. Here, under your situation, the property taken falls under Category A, but the replacement property falls under both Category A and Category B. As such, relief may be granted only to the residential portion of the property falling under Category A; the commercial (Category B) portion will be considered to have undergone a change in ownership and will be reappraised at fair market value.

As stated in question 9, relief can only be applied to the portion of the property that is of similar function and utility as the property taken. Thus, only the dwelling (Category A) portion of the property taken will be considered in determining the comparability and the amount of property tax relief granted. The right to relief on the commercial (Category B) portion of the property is waived unless comparable replacement Category B property is timely acquired and a timely request is made.

Relief will be granted on both the Category A and Category B properties based on the percentages of the adjusted base year value of the taken property that correspond to each of the replacement properties.

Each party can carry forward one-third of the base year value of $180,000 ($60,000) to a replacement dwelling. Any excess value of a replacement property will be reappraised at market value.

Property comparability with regards to size is associated with the value of your property -- not upon the square footage or other physical characteristics of your home. Property is similar in size if its full cash value does not exceed 120 percent of the award or purchase price of the property taken. The value of the new construction will be considered in determining the overall market value of the replacement property. Any portion of the total value of the replacement property over the 120 percent threshold will be reappraised at market value.

Yes. Neither section 68 nor Rule 462.500 limits the availability of relief to a single replacement property. Where multiple replacement properties qualify, the 120 percent threshold applies to the aggregated full cash value of the properties.

No. Acquisition of an ownership interest in a legal entity is not an acquisition of comparable property.

May a limited liability corporation (LLC) benefit from Prop 3 property tax relief?

No. Since the title to the replacement and original properties is not held in the same manner and name, both purchases by you and your business partner constitute a change in ownership, and there will be a reappraisal of both replacement properties at their fair market value. To receive Prop 3 tax relief, both replacement properties must be held in the name of the partnership.

The assessor will determine the base year value of the replacement property by comparing the award or purchase price paid by the governmental entity for the property taken with the full cash value of the replacement property:

1. If the full cash value of the replacement property does not exceed 120 percent of the award or purchase price of the property taken, then the adjusted base year value of the property taken becomes the replacement property's base year value, regardless of the allocation between land and improvements.

2. If the full cash value of the replacement property exceeds the 120 percent level, then the amount of full cash value in excess of 120 percent will be added to the adjusted base year value of the property taken. The sum of these amounts becomes the base year value of the replacement property.

3.If the full cash value of the replacement property is less than the adjusted base year value of the property taken, then that lower value becomes the base year value of the replacement property.

4. If an exchange occurs for which no award or purchase price is paid by the acquiring entity for the property taken, then the county assessor for each county in which the properties are located must determine the full cash value of both the property taken and the replacement property. Once the full cash values of both properties are determined, then the procedures of 1-3 set forth above will be applied to determine the replacement property’s base year value.

Yes. The replacement property can consist of more than one appraisal unit, with the value of the displaced property being allocated to the different replacement units for purposes of this exclusion. Each of the replacement properties, however, must meet the other requirements of section 68 (similar function, timely filing, etc.) to qualify.

An application must be filed with your county assessor using the form: Claim for Base Year Value Transfer - Acquisition by Public Entity (BOE-68). This form may be obtained from your county assessor's office or you may check your county's website as some counties provide a downloadable form. Your county's website may be accessed by clicking on the name of your county via the following link: http://www.boe.ca.gov/proptaxes/assessors.htm.

You have four years from: (1) the date the final order of condemnation is recorded when property is acquired by eminent domain; (2) the date of conveyance when property is acquired by a public entity by purchase or exchange; (3) the date the judgment of inverse condemnation becomes final when property is acquired by inverse condemnation; or (4) the date you vacate the property taken, whichever is later.

For property acquired by a public entity by purchase or exchange, your request for the base year transfer shall be deemed timely if made within four years of the date the condemnation is recorded or the date the taxpayer vacates the replaced property, whichever is later. In your case, the four-year statutory filing period will begin the date you vacate the premises at the end of your one-year lease of the property.

Yes. The applicant must provide proof of actual displacement. A copy of any one of the following documents will be considered by the assessor as such proof:

1. A certified recorded copy of the final order of condemnation, or, if a final order has not been issued, a certified recorded copy of the order for possession showing the effective date that the acquiring entity is authorized to take possession of the property taken.

2. A copy of the recorded deed showing acquisition by the public entity.

3. A certified copy of the final judgment of inverse condemnation.

4. A certified copy of a document that clearly indicates the name of the acquiring agency, the date condemnation proceedings began, and the date of possession by the acquiring agency.

5. Any other data requested by the county assessor.

Proposition 19 repealed the former parent-child and grandparent-grandchild exclusions that were added by Propositions 58 (1986) and 193 (1996). These exclusions described below are now inoperative as of February 16, 2021 and are only effective for parent-child or grandparent-grandchild transfers that occurred on or before February 15, 2021.

Proposition 58 had provided an exclusion from reassessment for certain transfers of interests in real property between parents and their children. The transfers must have been between individuals (not to include corporations, partnerships, other legal entities). "Children" must have been either naturally born to the "parents", legally adopted (before age 18), been the spouse of a child, or been a stepchild when the transfer occurred. The exclusion applied to transfers of the parties' principal residence, with no dollar limitation, or to other real property up to a maximum total assessed value of $1,000,000. The transfers may be sales, gifts, exchanges, etc. if all other criteria are met. Concerning transfers which take place upon death (such as by inheritance), the date of death is considered the date of transfer. This exclusion applied to both transfers from parent to child and child to parent. Assuming all of the criteria were met as of February 15, 2021 have been met, a valid claim form must be completed and filed timely with the Assessor’s office. Provided the property has not been sold to third parties, prospective relief is available from January 1 of the assessment year in which an exemption claim is filed. To obtain a Proposition 58 Claim form go to the forms section of this website or please contact the Property Transfer Unit at (408) 299-5540.

The following transfers of real property are affected by Proposition 58:

1. Transfers of the primary residences between parents and children.

2. Transfers of the first $1,000,000 of real property other than the primary residences between parents and children.

Children was defined by any of the following:

1. Any child born of the parent(s).

2. Any stepchild or spouse of that stepchild while the relationship of stepparent and stepchild exists.

3. Any son-in-law or daughter-in-law of the parent(s).

4. Any adopted child who was adopted before the age of 18.

It is the Proposition 13 value (factored base-year value) just prior to the date of transfer. Basically this is the taxable value on the assessment roll.

To receive a detailed answers go to: http://www.boe.ca.gov/proptaxes/faqs/propositions58.htm#10

1. Within three years of the transfer.

2. Prior to transferring to a third party.

3. Within six months of the mailing of a notice of supplemental or escape assessment.

4. The date of transfer occurred on or before February 15, 2021.

As often as you wish, provided that the taxable value being transferred does not exceed the first $1,000,000 from real property other than the primary residence and the transactions occurred on or before February 15, 2021.

The County Assessor will consider non-compliance to filing as a potential change of ownership, which would trigger a reappraisal and a possible increase in one's property taxes.

Proposition 60 and 90 were repealed as of March 31 by Proposition 19, which replaced Proposition 60 and 90 and expands a qualifying homeowners’ ability to transfer their base year value to another home anywhere in California.

Basically Proposition 60/90 allowed qualified taxpayers to transfer the assessed value of their original residence to a qualifying replacement dwelling without being reappraised at fair market value at the time of transfer. It was designed to allow older taxpayers downsize without being penalized by higher property tax payments.

Children was defined by any of the following:

1. Any child born of the parent(s).

2. Any stepchild or spouse of that stepchild while the relationship of stepparent and stepchild exists.

3. Any son-in-law or daughter-in-law of the parent(s).

4. Any adopted child who was adopted before the age of 18.

- The transfer of BOTH the original residence and the replacement dwelling must have occurred prior to April 1, 2021.

- The original property had to be eligible for the Homeowners Exemption.

- The replacement dwelling must have been of equal-or-lesser value and within the same county.

- The replacement dwelling must be purchased or newly constructed within two years of the sale of the original property.

- A claim for proposition 60 relief must be filed within three years of the date a replacement dwelling is purchased or new construction is completed.

Proposition 90 allowed the portability of base year values to a participating County. Santa Clara County was one of several participating counties in this program until it expired on March 31, 2021. Under Proposition 19, base year values can be transferred to any County.

The replacement property must be purchased, or it will not qualify for relief.

The claim form for Proposition 60 relief can still be obtained through this website by clicking here or from the Assessor's Office.

The claim for relief must be filed within three years of the date the replacement dwelling is purchased or the new construction of the replacement dwelling is complete. The transfer of BOTH the original residence and the replacement dwelling must have occurred prior to April 1, 2021. If either transaction occurs on or after April 1, 2021 the transfer will be subject to the provisions of Proposition 19, which are generally more expansive.

Property tax relief under this section included, but is not limited to: single-family residences; cooperative housing corporation units or lots; community apartment projects; condominium projects; planned unit development projects; mobilehomes; and owner's living units that are a portion of a larger structure, all as prescribed in subdividsions (c)(1) and (2) of Section 69.5.

This is one time only relief. Claimants are monitored by the State Board of Equalization in order to prevent multiple claims.

The replacement dwelling must be purchased or newly constructed within two years of the sale of the original property. The transfer of the BOTH original residence and the replacement dwelling must have occurred prior to April 1, 2021. If either transaction occurs on or after April 1, 2021 the transfer will be subject to the provisions of Proposition 19, which are generally more expansive.

No. The land/improvement ratio is retained. The only exception to this is when a Prop 13 base value is transferred to a licensed mobile home. Since the mobile home is not assessed, we need to make some adjustment to the allocation so that an allocated improvement value does not cause a distortion in the assessment.

As many transactions are quite complex, it is best to contact the Assessor's Office prior to the completion of all of your transactions. The Assessor’s Office will be more than happy to discuss your situation.